Atin, 53, works as a branch manager with a private bank. He had invested in an under-construction house in 2014. Fortunately, its price skyrocketed, prompting Atin to sell the property for a taxable profit of Rs 35 lakh. He now wants to know how he can save taxes and whether he should use this money to invest in another house.

The first two options

Before we explore the two options, let us explain how Atin will be taxed. In his case, the taxable profit - which is Rs 35 lakh - is termed as capital gains, and any property sold after at least two years falls under long-term capital gains. Long-term capital gains are taxed at a flat rate of 20 per cent, which means Atin must pay a Rs 7 lakh tax.

If you want to know how to calculate the taxable profit on selling your home, you can read this article.

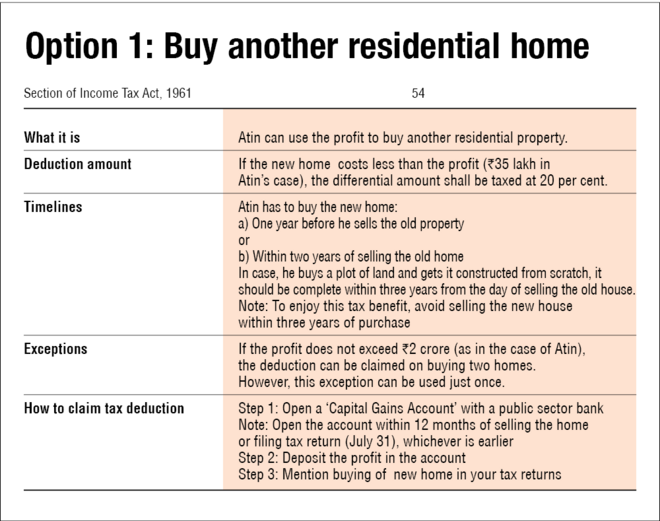

However, the income tax law allows claiming certain deductions to reduce tax liability. Here are the dominant options.

Should Atin buy another house?

- Atin was fortunate to see his property prices rise in the last eight years. But this may not happen every time. A real estate investment is a speculative affair.

- Further, it demands additional attention and cost in terms of finding a tenant, annual maintenance, etc.

- The average rental yield on a residential house is generally low and ranges around 2-3 per cent, which is even lower than inflation.

- Unless Atin finds a promising location or property, he should avoid investing in another house.

Should Atin invest in capital gain bonds?

- Capital gain bonds have an annual return of 5 per cent, which is lower than inflation.

- To make things worse, Atin falls in the highest tax bracket. So, his post-tax returns will be a lowly 3.5 per cent.

- However, these bonds assure safety of capital and guaranteed returns.

- Atin should invest in them only if he is looking to save long-term capital gains tax of Rs 7 lakh.

Is there a better option?

It depends on Atin if he can be patient and invest for more than five years. If he can, here's what we suggest:

- Pay the tax (that's right).

And invest the remaining amount in: - Invest the remaining amount in a phased manner (SIP or STP) over the next 18-24 months. Please don't invest the entire amount in one go.

Case for aggressive hybrid or flexi-cap

- Both aggressive hybrid and flexi-cap funds have a much higher return potential than capital gain bonds or residential property.

Atin can not only recover the tax paid (Rs 7 lakh in this case), but also build a larger wealth in the long run. - Let us give data to back our recommendation. If you look at the graph, we have compared how much Atin would be able to accumulate over the next five, seven and 10 years at three different post-tax returns:

- Both mutual fund types are clear winners. You can see that even after paying a Rs 7 lakh tax, Atin would be better off investing in either of the two types of mutual funds.