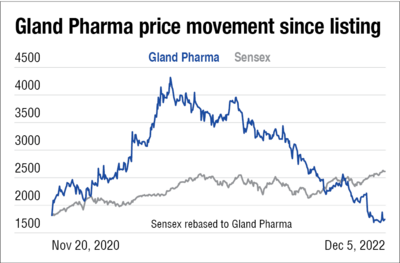

Gland Pharma was the pharma star of 2020. After listing at a premium of 21 per cent over its issue price, it delivered blockbuster returns of 137 per cent in the seven months that followed.

However, the rise of this pharma star has hit a snag. In the last three months, the stock has fallen 29 per cent, and what is even more jarring is that it fell by over 50 per cent in the last one year.

In this story, we investigate the blows that put the stock on life support.

First blow: A broken supply chain and COVID-related products

The premonition of what was to come was evident in the pharma company's financials.

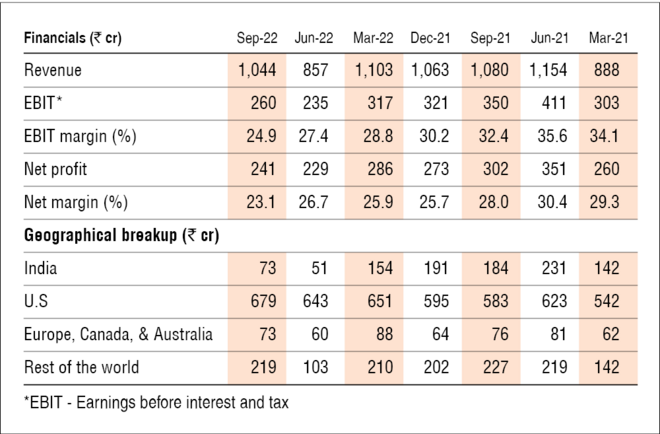

While the company rode high on its COVID-related products in the previous quarters, a rapid decline in their demand post COVID pushed the company's revenue down 6.4 per cent sequentially in Q2 FY22. Its revenue from the India business was hit the worst, registering a decline of 21 per cent.

While the next two quarters were decent, it was evident that the supply chain headwinds and falling COVID-related revenues will be a plague to its income for a while.

The supply chain issues worsened in Q1 FY23 and hit every segment. The India business was again the worst-hit, witnessing a massive 78 per cent YoY and 67 per cent QoQ decline. The COVID-related sales continued to dwindle, and the company had to shut down a dedicated insulin line for modifications, resulting in a loss of sales of around Rs 40 crore.

While revenue and profits in Q2 FY23 recovered sequentially due to better availability of materials and restarting of insulin lines, an inventory write-off of Rs eight crore and high freight and power costs pulled the margins down. The company also recorded its worst operating and net profit margin since December 2020.

Second blow: Restriction on Enoxaparin export

While the company was battling supply chain disruptions, it faced another blow in January 2022, with the government imposing restrictions on the export of Enoxaparin (an injection used to prevent a blood clot in arteries and veins). The stock price took a beating immediately following this announcement. The company was able to sell it to third parties post the restrictions, but it came at the cost of margins.

Third blow: Falling promoter stake

It is never a good omen when the promoters start showing signs of losing faith. In seven out of the last eight quarters since Dec 2020, the company's promoter, Fosun Pharma Industries, has sold small chunks of its stake in the company. Its stake in the company fell from 58.4 per cent at the time of the IPO to 57.9 per cent as of September 2022. This surely did no favours to the already declining market sentiment towards the company.

The story so far

The onslaught on the company's earnings for the last four quarters has surely bruised its prospects.

The management claims that next quarter will begin a road to recovery as the supply chain pressures ease, insulin production picks pace, and new products are launched.

However, external factors and their effects are always hard to predict.

At present, the nosedive of the share is yet to show any signs of stopping. In fact, it has fallen more than seven per cent in the last one week post the announcement of the acquisition of Europe-based Cenexi for around Rs 1,000 crore. According to the management, this move will help expand the company's CDMO (contractual development and manufacturing) business and ensure better exposure to European markets.

However, given Cenexi's relatively low margins and return ratios, the market feels otherwise.

In addition, during the first US FDA inspection post COVID in its Dundigal facility in Hyderabad, the company was handed an observation concerning an ANDA (abbreviated new drug application) filed for the product to be manufactured at the said facility. While this observation is rather benign, any issue raised by the US FDA deteriorates the market sentiment towards a pharma stock.

Suggested read: GOATs and three-season wonders