Ever since interest rates started undergoing a revision earlier this year, dynamic bond funds have become the talk of the town, with several fund managers joining the growing chorus in the last few months.

However, at Value Research, we still prefer the no-fuss short-duration funds and generally remain wary of dynamic-bond funds. And we have fairly valid reasons for that.

But before we get to the why, let's understand what dynamic bond-funds are.

How dynamic bond funds work

Dynamic bond funds have no investment constraints, meaning they can invest in both long- and short-term bonds to take advantage of interest rate cycles.

While in theory, this makes them an optimum all-weather option for debt investors, there is a catch. Here's why you should consider short-duration funds over dynamic funds:

Returns

Dynamic funds have delivered similar returns compared to short-duration funds.

In addition, they have also been more volatile.

Look at the one-year and five-year average rolling returns graphs. If we see the average one-year rolling returns of dynamic-bond funds over the last 10 years, they have moved from as high as 15 per cent to as low as one per cent.

On the other hand, short-duration funds have been relatively consistent, ranging from 3 to 11 per cent, despite having fewer investment options as compared to dynamic bonds. (Dynamic bonds have been given regulatory freedom to invest in short- and long-term bonds, while shorter-duration funds primarily invest in bonds that mature in one to three years).

Their five-year track record has been pretty similar as well.

This suggests that short-duration funds' limited investment mandate actually works in their favour. Less is better.

Maturity

Our strengths can also be our downfall, which holds true for dynamic bond funds too.

Since these funds can have independent interest-rate views, we feel this freedom can backfire because it is difficult for fund managers to accurately predict interest rates all the time.

And going by what's happening on the ground, it does seem that a few dynamic funds will get it wrong.

Here's why: while some funds have put their faith in short-term bonds, others are pinning their hopes on long-term bonds to generate competitive returns. As the graph suggests, the minimum and maximum maturity are 0.03 and 7.4 years, as of October 30, 2022.

This broad difference in strategy suggests there are two distinct camps in the industry and that one of them will eventually miss the mark.

Hence, these funds are way too 'dynamic' for our comfort and are more dependent on external factors, which is why investors should exercise caution.

Cost

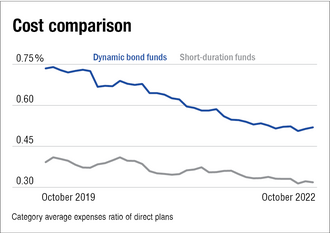

Further strengthening our argument in favour of short-duration funds is the high expense ratio of dynamic-bond funds.

Dynamic funds can charge up to 1.25 per cent for their direct plan, which can put some of the well-performing equity funds to shame.

On the other hand, the maximum expense ratio for a short-duration fund is a lowly 0.42 per cent.

On average, dynamic funds charge 0.52 per cent against short-duration funds' 0.32 per cent.

The expenses have come down over time, but they are still a fair distance away from matching their short-duration counterpart.

To sum up

Short-duration funds provide similar or better returns with less volatility and lower expenses. (If you wish to invest in short-duration funds, you may like to get our analyst-recommended funds here).

Suggested read: Floater funds: What they are and if you should invest?