About the company

KFin Technologies is one of India's only two registrar and transfer agents (RTAs). It provides data processing services to fund houses (keeping track of transactions and allocation of fund units, redemption, etc.) and acts as an interface between investors and fund houses. It also assists companies in their IPOs.

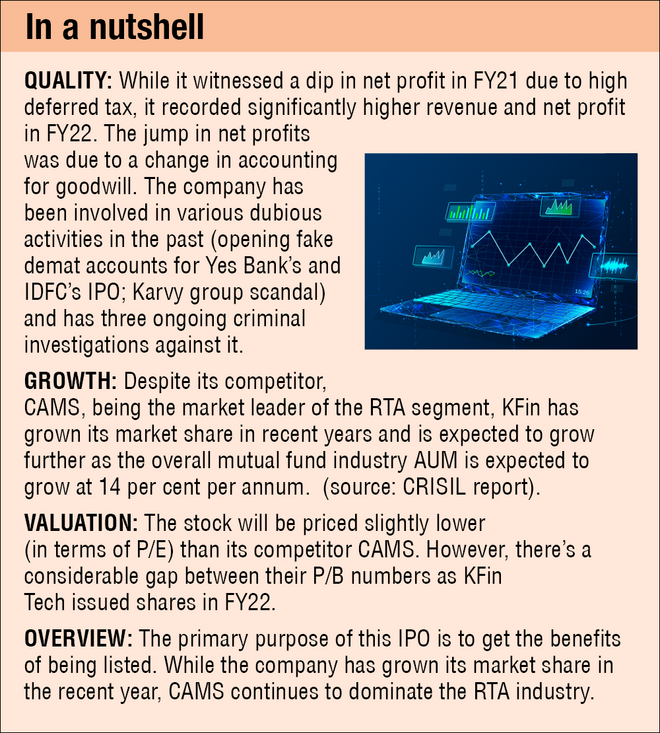

Strengths

- Improving market share: Despite the mutual fund industry having high client stickiness, the company's market share in equity AUM (47 per cent in FY20 to 54 per cent in FY22) and overall AUM have been on an upward trajectory (25 per cent in FY20 to 32 per cent as of September 2022). It onboarded seven out of the last 11 new AMCs in India.

- Player in an underpenetrated industry: India has an underpenetrated mutual fund industry compared to global standards. According to CRISIL, the total AUM of the mutual fund industry is expected to grow at 14 per cent per annum till FY27. Being one of the only two RTAs, the company stands to benefit from this.

Weaknesses

- Frozen shares: 14.1 per cent of its total shares, which the CP group holds, have been frozen on orders from the Enforcement Directorate.

- Data security risk: As the company's primary revenue source is data processing, any form of data breach will impact its market reputation and ability to attract new clients.

Disclaimer: This is not a stock recommendation. Do your due diligence before investing.

Suggested read:Landmark Cars IPO