November 22, 2022, the whistle blows. The mighty Argentina, spearheaded by magical Messi, sinks to its knees. Unable to keep the terrier-like Saudi Arabia at bay, their 35-win-streak confidence and World Cup-favourite status is neutered in a single fell.

Fast-forward a few weeks later, the same team - in their iconic sky blue and white vertical stripes - are seen lifting the Holy Grail of football, having seen off France in a nerve-jangling final.

In sports, a month is a long time - at least, that's what the pop doctors like to say.

But if you truly dig deep, the seeds of Argentina's destiny with the footballing gods were sown four years back, when an unfancied Lionel Scaloni was tasked to manage a team that had yet to shrug off its 2018 World Cup nightmare.

The appointment had raised several eyebrows then.

But the rest, as they say, is history: Scaloni, along with his namesake magician, engineered a remarkable turnaround by assembling a working-class team that could snarl and purr in equal measures, overcoming the previous edition's humiliation by winning the long-elusive trophy in Qatar.

What's intriguing is that Argentina's path to glory is a fable for investors, a moral lesson for the 'right here, right now' brigade.

Of long-term investing

Just like Lionel Messi's Argentina put its faith in patience to rise to the top, we too should mimic it in our investing journey.

Patience in investing is a superpower, more potent than even intelligence and talent.

This is aptly explained by Warren Buffet as well, who is hailed as the Oracle of Omaha and the big-daddy of investors: "Investing is not a game where the guy with the 160 IQ beats the guy with the 130 IQ. Once you have ordinary intelligence, what you need is the temperament to control the urges that get other people into trouble in investing."

It's especially true in mutual fund investing.

Perils of impatience

Going back to this year's FIFA World Cup, Argentina's shock loss to Saudi Arabia had left their reputation in tatters; other teams, such as Spain and England, leapfrogged them in the favourites sweepstakes.

A knee-jerk reaction would have been the easy way out in such a high-pressure cauldron, but the Argentinian camp admirably stuck to their guns to eventually taste glory.

Similarly, your resolve in a mutual fund investment should not be broken by short-term turbulence or flaring populism; it is important to put your faith in the long-term, given you trust the quality of your mutual fund investment.

Let's give you a real-life example. The historically-frontrunning Axis large-cap fund (Axis Bluechip Fund) stuttered this year, while the also-ran funds of Taurus and Indiabulls (Taurus Largecap Equity Fund and Indiabulls Bluechip Fund) formed the leading pack in the '12-month best performers' list.

Does this mean you shutter your Axis investment and look for greener pastures based on their one-year performance?

It can be lethal. While no one can predict the future, a fund's past performance can be a strong indicator of the future.

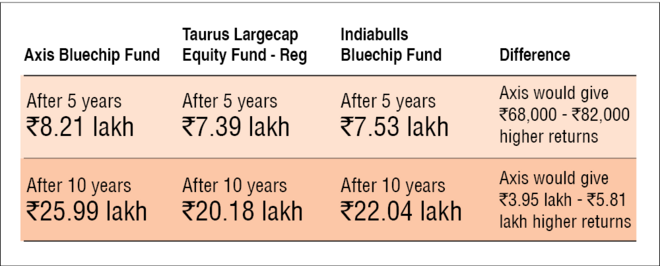

In the table here, you can see the importance of keeping patience. While Axis has been a traditional frontrunner, the other two have languished at the bottom in their 5-, 7- and 10-year performance.

Hence, by exiting your Axis investment hastily, you may be losing out on earning greater returns just because you decided to jump ship at the mere hint of a storm.

How much money you would lose based on their past performance

(If you made a Rs 10,000 SIP investment)

In short, you need to keep calm and let your investments do their kaam (work) - just like Argentina did even when the chips were down.

Suggested read: Five investment lessons from Roger Federer