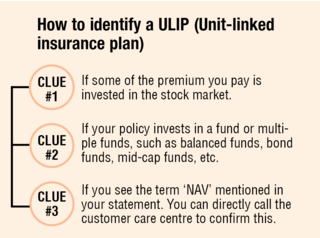

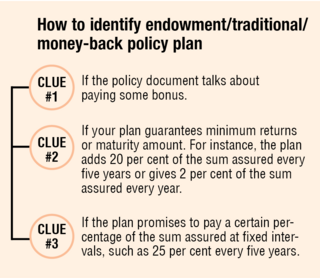

Are you sure you have an endowment or a money-back plan? Or is it a ULIP?

Before we get into the step-by-step process of surrendering your life insurance policy, let us ensure we understand what kind of insurance policy you own. This is an essential step because different policies have different surrender processes.

What we recommend

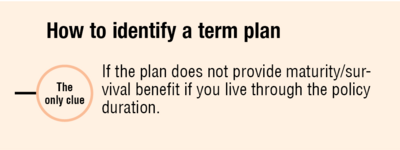

Of the three types of life insurance policies, term plans are the BEST! If you have a term plan, stick with it.

But please note there are a few term plans that promise to return the premium amount at the end of the policy. However, such plans are usually expensive and should be avoided.

But if you have a ULIP or an endowment/traditional/money-back policy plan and want to discontinue your relationship, here's what you need to do. (For those who have a ULIP, please visit this page).

Surrendering process of endowment/money-back policy

These policies usually have a two- or three-year lock-in period.

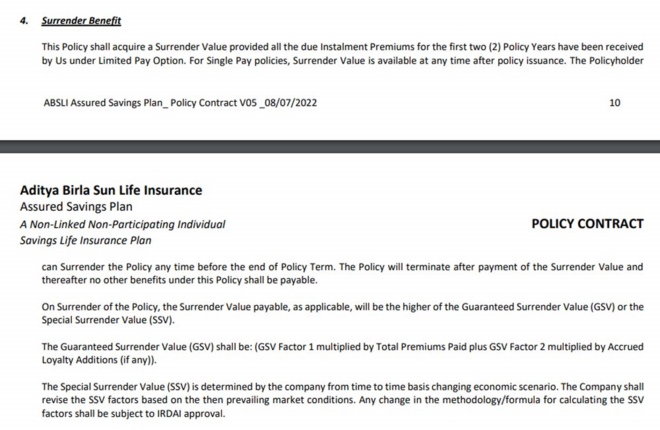

Confirm your policy's lock-in period by reading the 'Surrender' clause. It will be mentioned in the fine print of your policy document.

Surrendering your policy during the lock-in period

In most cases, if you discontinue paying your premium before completing the lock-in period, you will not receive any money from the insurance company.

In some cases, the policy may get converted into a paid-up policy. This option is available even after completing the lock-in period.

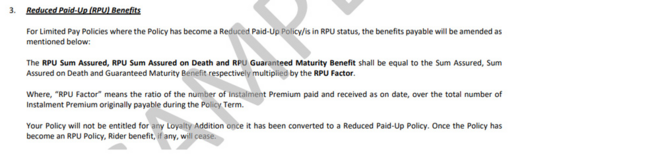

What is a paid-up policy

When you stop paying premiums but continue to get insurance coverage

- The benefits reduce accordingly

- Also, insurance companies generally do not pay any bonuses/other benefits that were initially promised

- The precise formula and terms & conditions are mentioned in your policy document

- You receive the paid-up value (the revised sum assured) after completing the policy duration

Surrendering after completing the lock-in period

- You need to visit your life insurance company branch. Please carry the original policy document, PAN, Aadhaar and a cancelled bank account cheque. These will be required along with the policy-surrender form, which should be readily available at the branch.

- The surrender value (the amount of money you would get now) would be based on a mathematical formula mentioned in the fine print of the policy document. Search for the 'Surrender' clause in the document.

- The charges deducted as a penalty for discontinuing the policy are generally steep in the initial years.

- If you surrender it in the first three to five years, chances are that you would get only one-third of the premium money paid by you.

- As in the case of ULIPs, the proceeds are transferred to your bank account

Paid-up vs surrender: Which one to choose?

There is no one-size-fits-all answer to this question.

It could differ even for two individuals having the same insurance policy. That's because the paid-up and surrender value depends on many variables:

- The tenure you had chosen while buying the policy

- The total amount of premium paid by you

- The number of years you have paid premium for

To get a precise answer, pick your policy document, go through the formulas mentioned under the paid-up and surrender clause and calculate which option would be more profitable for you.

The easier way would be to ask the branch executive of the life insurance company to provide you with the two figures.

- Paid-up value: How much money you will get on maturity if you stop paying your premiums from today

- The surrender value

You can then analyse which one is better.

Generally, if the maturity period is a long way off (say five to seven years or more), it could be worthwhile to get your money back and put it in investment avenues that provide better returns. Equity mutual funds can be one such option.

On the other hand, staying invested could be beneficial if your policy matures in a year or two. But as stated before, to get the precise answer, you will have to do some mathematics.

This is how the paid-up and surrender clause look for Aditya Birla Sun Life Assured Savings Plan

Suggested read: Say no to endowment policies and ULIPs