The Indian IT sector has always been susceptible to the winter blues. Historically, the third quarter of the fiscal year has meant some stagnation for the industry due to higher furloughs brought about by the year-end festivities. In addition, recession fears looming over Europe and the US, two of the key geographies for the Indian IT sector, added to the gloom of this quarter.

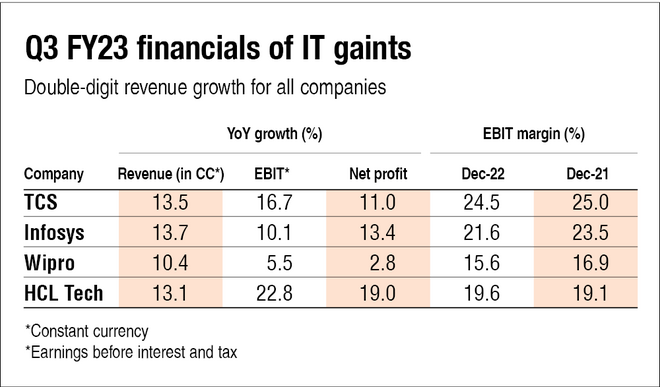

And truth be told, we weren't expecting a new year miracle either from the sector. So when the IT big four, namely, TCS, Infosys, Wipro and HCL Technologies, reported double-digit topline growth in Q3, with Infosys leading the pack at 13.7 per cent in constant currency terms, we were taken by surprise.

So what fueled the IT sector's departure from the trend of a weak third quarter?

Decline in attrition rate

Retaining talent has proved to be increasingly difficult for IT companies in recent years. Companies have had to dole out higher pay packages and bonuses to check the rising attrition rates at the cost of lower margins.

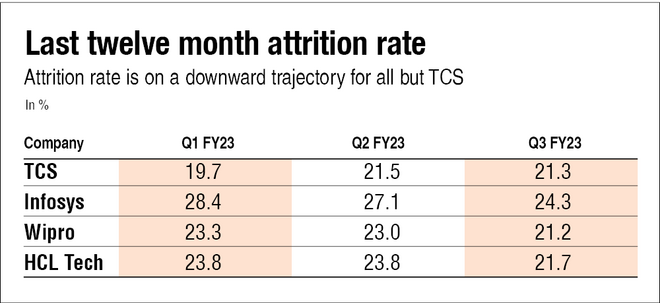

But it seems like the tech giants have finally found an answer to the attrition issue. In FY23, Infosys, which faced the highest attrition rate amongst the top players in the industry, witnessed a decline in attrition rates from 28.4 per cent in Q1 to 24.3 per cent in Q3.

However, whether employee costs would also come down with the attrition rate remains to be seen.

Higher TCVs

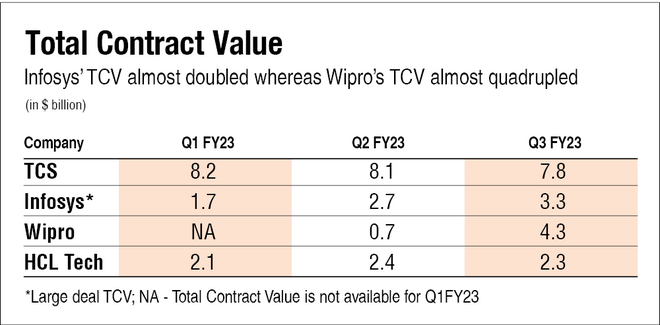

Total Contract Value (TCV) is a metric that signifies how much a contract is worth to a company after it has been executed. In simpler terms, it is an estimate of how much a company will earn from a client once a contract has been signed. It includes all recurring revenues, such as subscription fees, as well as one-time fees a company might charge at the signing of the contract.

In FY23, most tech giants witnessed a jump in their TCVs, with Wipro posting the widest jump from $0.7 billion in Q2 to $4.3 billion in Q3 (its highest ever).

What lies ahead

It is always heartening when a company not only posts healthy results but also exuberates confidence in keeping the momentum going.

The management of most of the IT leaders are optimistic that these impressive numbers won't be a one-off and have increased their guidance. For instance, Infosys has increased its revenue growth guidance from 15-16 per cent to 16-16.5 per cent for FY23. Similarly, the managements of HCL Technologies and Wipro are confident of achieving year-on-year revenue growth in the range of 13.5-14 and 11.5-12 per cent, respectively.

Suggested read: Should you invest in cyclical stocks?