Buy low and sell high. That's how you make money in the market. But taking this motto too literally leads to a lot of misconceptions.

Investors often forget that you should look at valuation after exploring a business's fundamentals. Investing solely based on valuations is akin to rolling the dice and expecting returns will materialise.

Take the obsession around the valuation metric price-to-earnings or P/E. P/E is calculated by dividing a company's market capitalisation by its last 12-month earnings. And the metric is indeed helpful in gauging if a business is overvalued or undervalued. If a company has a high P/E, chances are market sentiments are driving its price up more than the performance of the underlying business. Similarly, a low P/E might mean a good company is going unnoticed by the markets.

However, "might" is the key word here. Financial metrics are efficient tools for evaluating performance, but they are not a guarantee for returns. And P/E is no different.

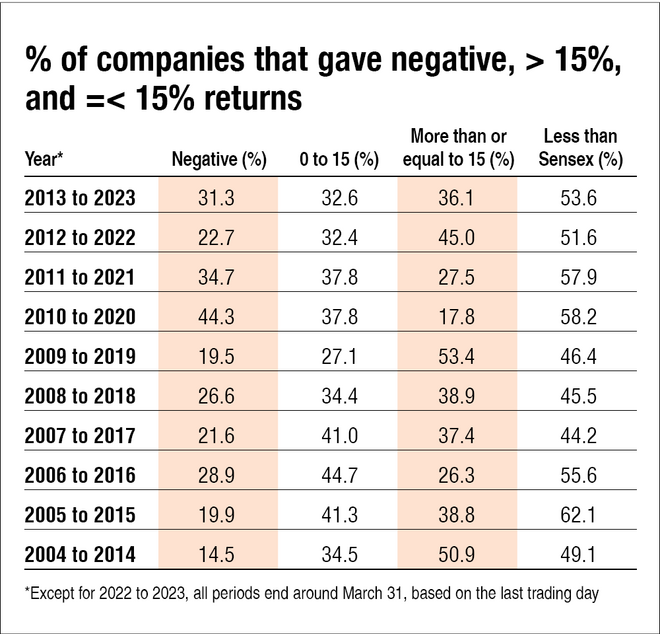

Let's test the popular belief that a low P/E means an undervalued but fundamentally strong company. To find out if this is true, we took BSE companies with a present market capitalisation of more than or equal to Rs 100 crore. Next, we looked at periods in the last decade when these companies traded at a P/E of less than or equal to ten and evaluated how much returns they gave investors in ten years and if they beat Sensex. To strengthen our case, we looked at ten such decade-long periods.

As you can see from the table, on average, about only half or 50 per cent of the companies beat the benchmark index. That means if you invested in these companies based on their P/E, you would have a 50-50 chance of beating the market. In the worst-case scenario, you would have suffered severe capital loss.

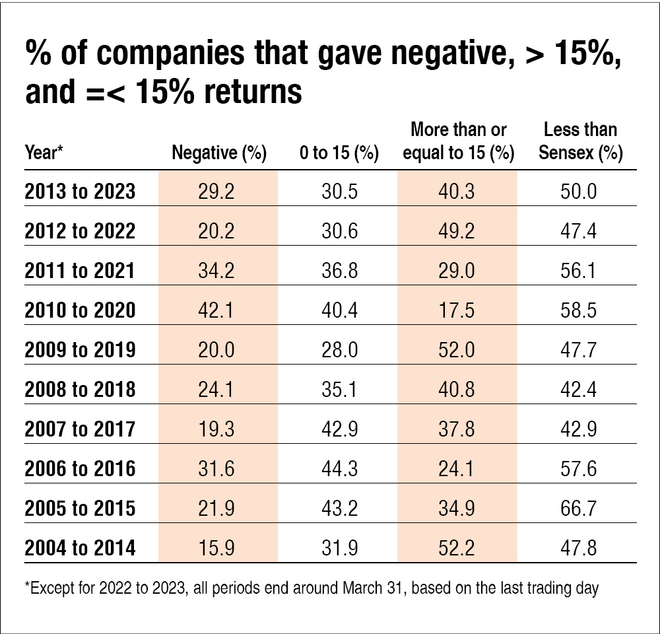

But maybe a P/E of less than or equal to ten is too low, and the markets devalued them for the right reasons. So, let's take a P/E of less than or equal to 15.

As you can see, the results are quite similar.

The worrying part about the results is that in almost all of the decade-long periods we looked into, a huge chunk of the companies either gave higher than 20 per cent returns or gave negative returns. Essentially, investing like this boils down to you either win big, or you lose everything, which should never be your investing philosophy if you want to build wealth.

In short, low valuation doesn't always mean undervalued. At times, a stock is cheap for a reason.

Suggested read: Don't blindly chase discount to book value