The doomsday is here, the sirens are ringing, and it's time to exit and run. We get it. Every time the market crashes, the ensuing panic is natural, especially for a retail investor.

But how fruitful is this defence mechanism? No, we are not saying your fear is unfounded. But is a market crash truly a good enough reason to exit your positions?

Well, Warren Buffett thinks it's not. "A market downturn doesn't bother us. It is an opportunity to increase our ownership of great companies with great management at good prices," says Buffett.

And we agree. When the markets are witnessing a downturn, it inadvertently opens up lucrative investment opportunities.

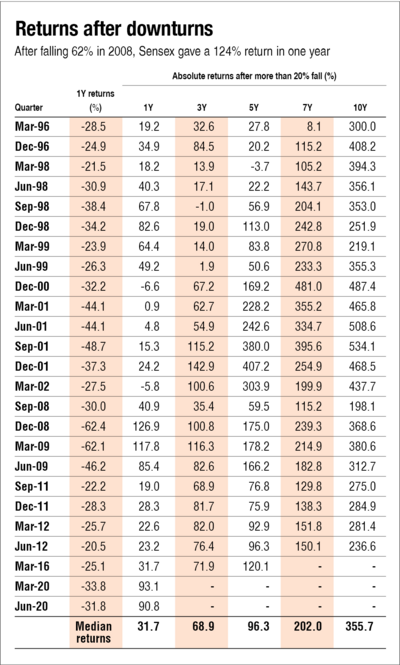

To further prove our point, we conducted this simple exercise. First, we did some digging and found out each instance when Sensex gave less than (-) 20 per cent return in a year on a quarterly rolling basis (in non-technical lingo, a drastic market downturn). Next, we calculated how much returns the BSE benchmark index gave in one year, three years, five years, seven years, and ten years since those market downturns.

Key highlights

- Sensex has never given negative seven- and ten-year returns after any downturn.

- It has given negative three- and five-year returns only once since a downturn.

- Barring one instance, the Sensex's ten-year return has been more than 200 per cent after every downturn.

In short, if you had stayed invested or made new investments during the market downturns, you would have made significant gains over the years.

We at Value Research have always iterated that investing for the long term is a core tenet of wealth building. The markets will always be volatile. There will be ups, and there will definitely be downs. But if your ship is strong, it will sail through even the worst of storms.

In short, keep the focus on identifying fundamentally strong businesses, invest for the long term, and the next time someone screams about impending financial doom, drown out the noise.

Suggested read: Investigating the indices