India's inaugural Amrit Kaal budget enthused the markets as it added more muscles to the capital expenditure outlay and vowed fiscal consolidation despite multiple headwinds.

The new tax regime, in particular, received special attention in this budget. Today's rejigging softly nudges the middle-class to adopt the new structure. While the new system packs in some benefits for the middle-class, it undermines the importance of purchasing insurance plans and investing in tax-saving options that build wealth in the long run.

That said, this year's budget covered a lot of bases, ranging from insurance to gold to the launch of guaranteed regular income options. Here's a recap of Budget 2023-24:

Rebate limit raised

- The rebate limit under Section 87A has increased from Rs 5 lakh to Rs 7 lakh for those under the new tax regime.

- This means people earning up to Rs 7 lakh in a financial year (after adjusting the deductions) need not pay any tax.

Reduction in tax slabs

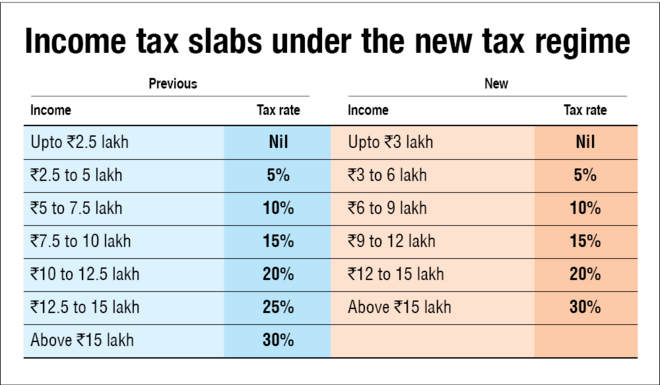

The number of slabs in the new tax structure has reduced from 6 to 5.

Introduction of standard deduction

Benefit of standard deduction (Rs 50,000) to salaried class and pensioners has now been extended to the new tax regime also.

Reduction in surcharge rate

The surcharge rate on income exceeding Rs 5 crore has been reduced from 37 per cent to 25 per cent in the new tax structure. This means the highest surcharge rate now would be 25 per cent on income above Rs 2 crore.

Confused between the old and new tax regime? This tax calculator gives you the answer.

Relief for retiring non-government employees

Tax exemption limit for leave encashment on retirement for non-government employees increased from Rs 3 lakh to Rs 25 lakh.

This should provide for a little more money in their hands for their post-retirement life

Launch of women-only saving scheme

Mahila Samman Savings Certificate, also known as Mahila Samman Bachat Patra.

- A one-time small saving scheme

- Can invest between April 2023 and March 2025

- Women can deposit a maximum Rs 2 lakh

- Interest rate: 7.5 per cent

- Investment tenure: 2 years

- Partial withdrawals allowed (which is a positive)

- Taxation structure: Not known yet

SCSS limit raised: A welcome move

- Individual subscribers: Deposit cap raised from Rs 15 lakh to Rs 30 lakh.

- If you invest jointly with your spouse, the limit has doubled to Rs 60 lakh.

- Since SCSS offers 8 per cent per annum, this is an attractive option for senior citizens.

Post office monthly income ceiling raised

- Maximum deposit limit for single account holders raised from Rs 4.5 lakh to Rs 9 lakh.

- For joint accounts, it has gone up from Rs 9 lakh to Rs 15 lakh.

- Offers an interest of 7.1 per cent per annum, payable monthly.

Mum's the word on PMVVY

- Interestingly, there was no mention of Pradhan Mantri Vaya Vandana Yojana.

- One can infer that this retirement scheme may not extend beyond March 31, 2023.

Body blow for high-valued insurance policies

- Income from insurance policies with premiums above Rs 5 lakh will now be taxable.

- It will not apply to proceeds of death benefits or for policies issued before March 31, 2023.

- This may nudge people to buy term insurance policies instead of traditional policies with high premiums. But beware of ULIPs though.

Other changes at a glance

- The new tax regime will now be the default option for citizens.

- The ITR form will be streamlined further.

- No capital gains for converting physical gold to electronic gold receipt, and vice versa.

- Cap on deductions of up to Rs 10 crore capital gains for residential property transactions under Sections 54 and 54F.

- Reduction in TDS for EPF money for non-PAN cases from 30 per cent to 20 per cent.

- 360-degree review of existing financial sector regulations. Option of public consultation, if needed.

- Portal to be built for investors to easily recover unclaimed shares and unpaid dividends.

Suggested read:

Budget 2023 & the business

Should you invest in Mahila Samman Savings Certificate?