There's a new small savings scheme in town: Mahila Samman Savings Certificate (MSSC).

It's a one-time small saving scheme for women, providing an assured return of 7.5 per cent annum.

Mahila Samman Savings Certificate: At a glance

- Will invite investments between April 2023 and March 2025

- You can invest up to Rs 2 lakh

- The investment tenure is two years

- The interest rate is 7.5 per cent per annum

- Partial withdrawals are allowed

- The taxation structure is not known yet

While MSSC is yet to open for public subscription and some details remain unknown as of now, let's take a look at its pros and cons.

The pros

Its 7.5 per cent assured return is only behind the Senior Citizens Savings Scheme's 8 per cent and Sukanya Samriddhi Yojana's 7.6 per cent.

Also, partial withdrawals are allowed - an option not easily available with Sukanya Samriddhi Yojana. However, we are yet to learn how partial withdrawals will work in MSSC.

The cons

Despite an attractive rate of return, we don't think it will make a big difference to an investor, given the investment limit of just Rs 2 lakh (one time) and a very short tenure of 2 years.

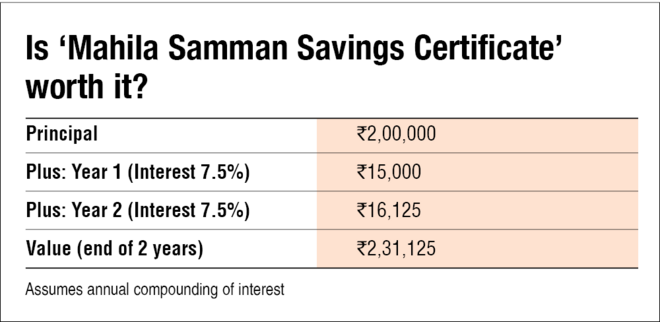

Let's do the math!

Say you invest the maximum possible amount in Mahila Samman Savings Certificate, which is Rs 2 lakh. You'd earn Rs 15,000 in the first year and Rs 16,125 in the second. That makes your Rs 2 lakh investment a little over Rs 2.31 lakh at the end of the investment tenure, given the investment tenure is just two years.

That doesn't really make much of a difference to your wealth.

And if the interest income is taxable, which is unknown yet, it further dents the amount you take home.

Confused between the old and new tax regime? This tax calculator gives you the answer.

The verdict

If you are looking to invest for two years only, Mahila Samman Savings Certificate can be a worthwhile option, as post office time deposits and bank fixed deposits are the only rivals in the assured returns space. But they both offer lower returns.

That said, if wealth creation is your goal, you can give this scheme a pass.

We will keep an eye on this scheme and will notify you with further updates.

Suggested read:

Budget 2023 & your money

Budget 2023 & the market