From Washington to Beijing, the implication of India's union budget is far-reaching. And with India overtaking the UK as the world's fifth-largest economy, the anticipation around this year's budget was unprecedented.

So how will the India story unfurl this year?

Here are some key highlights from the Union Budget 2023 that will be pivotal in steering India's economy.

- Over Rs 20 lakh crore will be spent on upscaling the animal husbandry, dairy and fisheries sectors.

- Capital investment outlay has been increased by 33.4% to Rs 10 lakh crore.

- Highest-ever capital outlay of Rs 2.4 lakh crore for railways.

- 100 transport infrastructure projects identified for end-to-end connectivity for ports, coal, steel, and fertiliser sectors.

- The 50-year interest-free loan to State governments will continue and incentivize infrastructure investment.

- Rs 2,200 crore will be used to boost Horticulture crops under the Atma Nirbhar Horticulture Clean Plant program.

- Rs 35,000 crore will go towards priority capital investments for energy transition and net zero objectives.

- Rs 10,000 crore will be used under the GOBARdhan (Galvanizing Organic Bio-Agro Resources Dhan) scheme to create 200 new compressed biogas (CBG) plants, including 75 plants in urban areas and 300 community or cluster-based plants.

- Rs 6,000 crore will be allocated to fishermen, fish vendors and micro & small enterprises under PM Matsya Sampada Yojana.

- A credit guarantee scheme for MSMEs has been announced, which will enable additional collateral-free guaranteed credit of Rs 2 lakh crore.

- Rs 75,000 crore will be spent on building 100 critical transport infrastructure projects for last- and first-mile connectivity for ports, coal, steel, fertiliser, and food grains sectors.

- Rs 20,700 crore will be used to construct an Inter-state transmission system for the evacuation and grid integration of 13 GW of renewable energy from Ladakh.

- To enhance the ease of doing business, more than 39,000 compliances have been reduced, and more than 3,400 legal provisions have been decriminalised.

- Phase 3 of the E-Courts project will be launched with an outlay of Rs 7,000 crore.

- To promote traditional artisans and craftspeople, a package has been conceptualised under PM Vishwakarma Kaushal Samman.

- To boost tourism, at least 50 destinations will be developed for domestic and foreign tourists.

- Rs 2 lakh crore will be spent on supplying free food grain to priority households for one year starting January 1, 2023, under PM Garib Kalyan Anna Yojana (PMGKAY)

- More teachers will be recruited for the 740 Eklavya Model Residential Skills.

- 157 new Nursing colleges will be established.

- 100 labs will be developed for 5G services-based application development.

Confused between the old and new tax regime? This tax calculator gives you the answer.

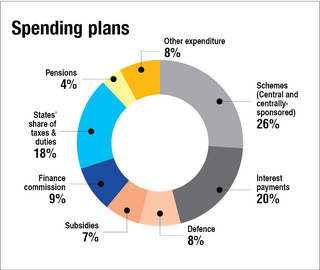

Top three ministries in terms of allocation

- Ministry of Defence - Rs 5.9 lakh crore

- Ministry of Road Transport & Highways - Rs 2.7 lakh crore

- Ministry of Railways - Rs 2.4 lakh crore

Allocation to major schemes

- Development of pharmaceutical industry - Rs 1,250 crore

- Jal Jeevan mission - Rs 70,000 crore

- Pradhan Mantri Awas Yojana - Rs 79,590 crore

- Faster Adoption and Manufacturing of EVs (FAME) - Rs 5,172 crore

- North East Special Infrastructure Development Scheme - Rs 2,491 crore

Suggested read:

Budget 2023 & the business

Budget 2023 & the market