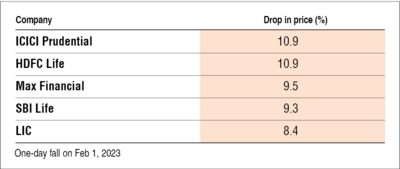

The waves of the Union Budget 2023 were fast to hit the market. As soon as the news about the limit on tax exemption from insurance proceeds was in the air, shares of life insurance companies plunged.

The finance minister has proposed that high-value life insurance policies (except ULIPs), where the premiums aggregate to more than Rs 5 lakhs, will not be exempted from taxation. This move is to primarily stop the misuse of exemption under Clause (10D) by high net-worth individuals.

However, the new limit will only be applicable to insurance policies issued on or after April 1, 2023.

Confused between the old and new tax regime? This tax calculator gives you the answer.

What's in store for insurers and policyholders?

The new limit on the tax exemption from insurance proceeds will surely have an impact on the topline of life insurers. Moreover, the top brass of many insurance companies fear that the new limit on tax exemption will deter people from purchasing additional policies once they use up their exemption limit.

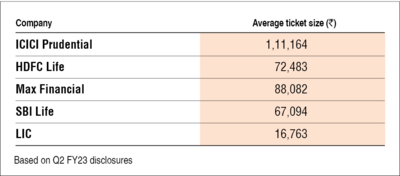

However, based on the average ticket size (average size of insurance policies sold by a company) in the industry, this move should impact only a small group of policyholders.

Suggested read: Which tax regime is better after Budget 2023