The government's focus on a greener India was quite evident in the Union Budget 2023. However, some of the announcements made by the finance minister left investors in fertiliser companies feeling blue.

But are these announcements really that concerning?

A not-so-surprising drop in subsidies

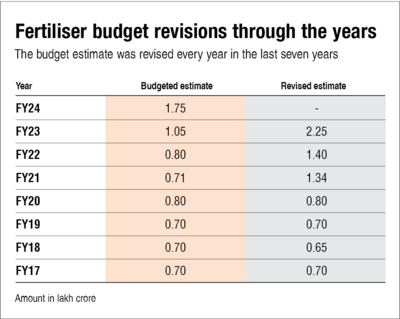

When shareholders heard that the government wouldn't be spending more than Rs 1.75 lakh crore (a 22 per cent drop from the previous year's revised estimate) on fertiliser subsidies this fiscal, they were left distressed.

However, the government's budget for subsidies is not set in stone. It determines the subsidy budget based on prevailing raw material costs. When raw material prices go up, production costs go up, and the government revises its budget to provide some respite.

For instance, when raw material prices jumped in FY23, the government stepped in and revised its subsidy budget. And now that the prices are under control, it has again revised its budget.

In fact, historically this has been the norm.

In short, while the recent announcement might have some short-term impact on share prices, it will be business as usual in the long term.

Chemical fertilisers are not going anywhere anytime soon

The PM Programme for Restoration, Awareness, Nourishment and Amelioration of Mother Earth or the PM PRANAM scheme, is the latest addition to the government's list of schemes to check the rampant soil degradation plaguing India.

Under this scheme, the central government will incentivise state governments to promote alternative fertilisers (organic and biofertilisers) and balanced use of chemical fertilisers, which are notorious for causing soil degradation.

While this may have an impact in the distant future, there is still some time left before India can completely switch to biofertilisers. Investors shouldn't forget that India is a fertiliser deficit country. So even if farmers switch to biofertiliser in large numbers, it still wouldn't cover the deficit, and there would be ample room for chemical fertilisers to co-exist.

The final verdict

While there might be some short-term fluctuations in share prices, the impact on business operations will be minimal, if any. Moreover, claiming that it's the end of the road for chemical fertiliser before the government has even chalked out a long-term plan for biofertilisers borderlines on doomsday mongering. The government also increased its agriculture credit target to Rs 20 lakh crore, which is not only a positive for fertiliser companies but also for agrochemical and other agri-related companies.

Also read: Tough times ahead for life insurers