A simple product does not always equate to a simple industry, and the cement industry is a prime example.

While it is hard to list a product simpler than cement, the Indian cement industry is ripe with intricacies, deciphering which can humble even the most veteran of investors.

So, if you are planning to throw in some cement producers in your portfolio mix, here are a few things you should know about the industry.

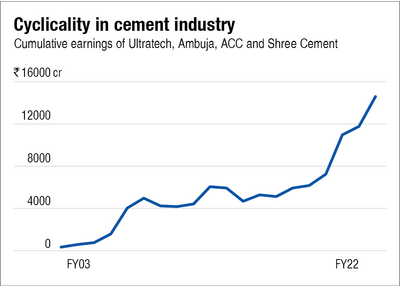

It is a cyclical industry

When the economy is doing great, credit is cheap and both the public and private sectors take on new infrastructure projects. This leads to a higher demand for cement, and the earnings of cement companies shoot up. However, the reverse happens when the economy is in the doldrums.

This creates cycles of ups and downs in the industry's earnings.

As you can see, the fluctuations in earnings are not as drastic as seen in some other cyclical industries like steel, and in the long term, there's a clear upward trajectory. However, you should get comfortable with high short-term volatility if you plan to invest in this sector.

It's a cut-throat cost game

If someone gave you cement produced by two different brands and asked which is which, would you be able to tell the difference?

While cement brands plaster their name on the bags, their products are indistinguishable, and hence, there's no client stickiness. As long as it's cement, consumers do not care. However, despite this, some big players do spend considerable amounts on advertisements to raise brand awareness.

But, building a consumer base boils down to who can offer better cement at the cheapest rates.

To do that, cement producers try to cut down on the following primary expenses.

1. Power and fuel

Limestone, silica, iron oxide, and alumina. You put them in a kiln, heat them until they melt, and viola, you have cement.

However, melting these materials requires fuel, primarily coal and petcoke. Nearly half a gram of coal is required to produce a gram of cement. Hence, fuel costs account for a huge chunk of production expenses for cement producers. For instance, Ultratech's and Ambuja's (two industry leaders) average power & fuel cost as a percentage of revenue in the last five years is 21 per cent. So in order to secure a steady supply, they enter into agreements with coal mining companies.

2. Raw materials

What sets the cement industry apart is, in addition to high raw materials cost, cement producers have to deal with availability issues. Limestone is the primary raw material to make cement, and producers have to acquire mining licences from the government to procure it. And it doesn't stop there. They have to keep paying royalties on those mines. Unsurprisingly, new players find it difficult to acquire these licences, which gives the existing industry leaders an advantage.

3. Transport costs

Cement is heavy, and hence transporting it is not cheap. Ultratech and Ambuja's average transportation cost as a percentage of revenue in the last five years was as high as 23 per cent and 21 per cent, respectively.

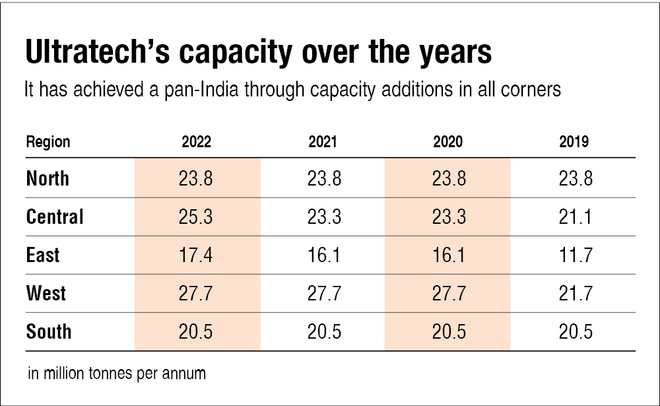

As a result, smaller players must restrict their operations to regions near their plants. The only way to achieve a pan-India presence is to build plants near raw material mines across the country. And the big players have done so.

For example, Ultratech, a market leader, acquires raw materials and has plants all over the country.

The more the production, the better

Whether a cement company produces 100 MTPA (metric tonnes per annum) or 20 MTPA, it still has to pay a royalty for its limestone mines. In addition, producers have to bear other large fixed expenses. Hence, it doesn't make sense to keep production low.

Thus, cement producers are always trying to expand their capacity. For example, Ultratech, despite having a total capacity of 120 MTPA (more than that of the next two players combined), has proposed to increase it to 159 MTPA.

Multiple sale channels

This might come as a shock to the uninitiated, but cement producers can actually act like D2C companies. Well, at times.

Cement is sold primarily through two channels: Trade and non-trade.

In the trade channel, cement reaches consumers through dealers. Usually, this is the route for smaller infra projects as the bulk of cement required is low.

In the non-trade channel, producers sell cement directly to consumers. This is usually the case for large infrastructure projects.

While the non-trade channel has certain cost advantages, such as lower transportation costs (due to bulk quantities) and not having to pay commissions to dealers, the trade channel is more profitable as it allows producers to charge higher prices.

Dominated by the leaders

You might have predicted this already. The market leaders control the cement industry. While small producers might have some local strongholds, cartelisation is rampant in the industry and market leaders run the show. In 2018, the CCI even imposed a penalty of Rs 6,300 crore on the top 11 cement producers for unfair competitive practices.

To sum up

While from the above it is clear that the big players are the safest bet in the industry, we encourage investors to do the due diligence on a company's fundamentals before investing. Sectoral analyses can only provide a glimpse at the dynamics of an industry. However, the fundamentals of a business should always take precedence when deciding whether to invest or not. Moreover, as this is a cyclical industry, investors uncomfortable with volatility should think twice before investing.

Suggested read: Hold your horses fertiliser investors