Cluttered table, empty tea cups, chaotic schedule, and a constant stream of unpredictable work demands and phone calls. This is a typical day in the life of self-employed and freelancers.

Managing personal finance on top of everything else can seem impossible.

Further, given that freelancers and self-employed individuals can't precisely project how much they will earn, managing personal finance seems even more challenging.

But there's one thing we do know. Since you get no employee benefits - insurance, stable income, and money flowing to retirement schemes - financial planning is even more essential. Which is why you have to take care of your own money. This story shows you how.

Step 1: Safety belt

One hospitalisation or an emergency can knock out your finances ice-cold. Hence, the need to get insurance.

- Health insurance - The first step in your financial planning journey is to buy adequate health insurance for yourself and your family. Read how you can evaluate a health policy and buy it online.

- Life insurance - You must buy life insurance if you have financial dependents and want to secure their future. This term insurance guide will answer all your questions.

- Emergency corpus - Since you never know what nasty surprises you might encounter down the road, it's always better to have some buffer money by your side, like a stepney. We suggest you calculate your monthly expenses (both personal and professional) and set aside a sum that can cover you for at least six months.

The mental peace they bring should help you focus better at work.

Step 2: Keep the steering stable

As a non-salaried earner, investing with discipline is hard. But not doing so will only make your life harder. So, here's a simple approach:

- Your income may vary, but you must know the minimum amount you'd receive each month.

- Then, calculate the amount you need to cover your basic expenses (both personal and professional) every month. Keep some fun money based on your lifestyle.

- Subtract your expenses from the minimum amount you expect to earn monthly. What's left should be your monthly investment.

- What to do with the extra income you earn each month? We'd suggest you sit down periodically (at least every three months) and ascertain the amount that can be invested.

Pro tip: Keep separate bank accounts for personal and professional use for better tracking and tax purposes.

Mutual fund SIPs (systematic investment plans) are a convenient way to keep this going. You can start with as low as Rs 500.

We will come later to the type of fund you should consider.

Pro tip: Do not invest the entire surplus income into the business. While such investments can be rewarding professionally, they are illiquid and unavailable for personal use.

Bonus tip: Don't put a large chunk of the money in equity-oriented mutual funds in one go. That's because the stock market is really volatile, and a sudden slump in your investments can give you sleepless nights.

This is where Systematic Transfer Plan (STP) steps in.

STPs allow you to move your money from one fund to another. So, you can transfer the surplus income to a debt fund and set up an STP. By doing an STP, you'll allow the money to move from the debt fund to an equity fund of your choice at regular intervals.

This has two other benefits. One, until your money moves to an equity fund, you would earn better returns than in an ordinary savings bank account. Two, you would save yourself from splurging that money.

Step 3: Your investment roadmap

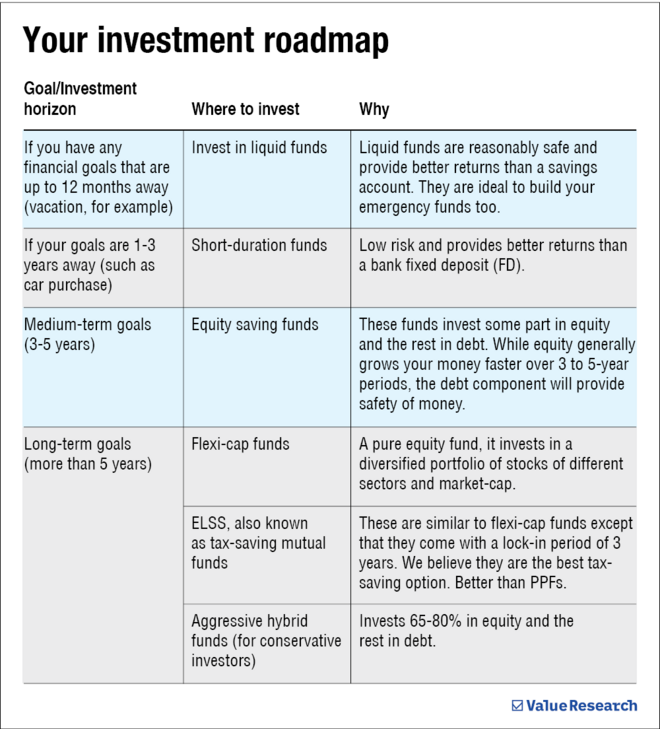

You don't have to bang your head analysing all kinds of investment products available in the market. Thankfully, we have mutual funds that can cater to any investing need you may have.

In case you need to learn what mutual funds are and how they work, visit Get Started.

What's important is that you choose suitable mutual funds for investing your money. To determine this, you need to factor in your goals and time horizon, as explained in the table below.

That's it.

Follow these three steps to ensure income fluctuations don't obstruct your goals of building wealth in the long run.