Veterans pinch their noses whenever a company mentions EBITDA. The legendary Charlie Munger of Berkshire Hathaway once said, "I think that every time you see the word EBITDA, you should substitute the words bullshit earnings." And for a good reason.

EBITDA stands for earnings before interest, tax, depreciation and amortisation. Now say a company earned Rs 200 crore in revenue and had to spend Rs 80 crore in operating expenses in a quarter. So that means Rs 120 crore of earnings and a margin of 60 per cent! Stellar numbers, indeed.

But are they?

What if the company had taken enormous debt and had to pay Rs 100 crore as interest payments? And what about its assets? Surely, they are not blessed with immortality and will depreciate over time.

This is why investors are not fond of EBITDA as a gauge of profits. While EBITDA can help in the valuation of young companies, it can be guilty of ignoring expenses that are part and parcel of running a business. In fact, EBITDA is a non-GAAP (Generally Accepted Accounting Principles) metric, meaning regulatory bodies also view EBITDA in the same light as Charlie Munger.

Now that you know why EBITDA numbers can paint a false narrative, let us introduce you to its infamous cousin, adjusted EBITDA.

When good ol' EBITDA is not enough to save face, you add back non-recurring costs to your EBITDA, and voila, you have adjusted EBITDA.

And what constitutes non-recurring costs? Everything the company deems non-recurring. There's no framework. From ESOPs (employee stock ownership plan) to marketing expenses, anything can be considered as non-recurring and added back to EBITDA.

Neat trick, indeed. To the surprise of none, these non-recurring expenses are rarely non-recurring.

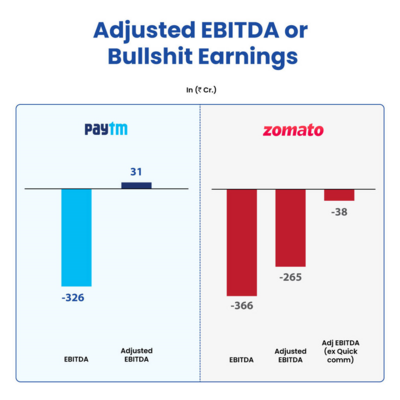

For instance, Paytm reported an adjusted EBITDA of Rs 31 crore. How? It added back ESOP (employee stock ownership plan) expenses to its Rs (-) 326 crore EBITDA. But are ESOPs really non-recurring, given that the company grants them regularly?

And it's not just Paytm. More and more loss-making companies are trying to hide behind this age-old gimmick. Zomato added back ESOPs and losses it incurred in its quick-commerce segment to its EBITDA and reported an adjusted EBITDA (ex. quick commerce) of Rs (-) 38 crore. In reality, its EBITDA was as low as Rs (-) 366 crore.

What you can do as an investor

In short, read annual reports, keep it simple and stay away from these false narratives. Always remember, the only time a company has to rely on these gimmicks is when the balance sheet is saying a different story. Since the birth of markets as we know them, companies have always come up with ever-innovative ways to hide their losses. As investors, we have to stay vigilant, not follow the hype and also do our due diligence before investing no matter what the social media buzz is saying.

Suggested read: Don't lose sleep over downturns