The relatively strong performance of government-run companies in recent times has sparked the revival of dividend yield mutual funds. The SBI Mutual Fund house launched the first-time subscription offer to their dividend yield fund on February 20. The last date is March 6.

Below is a snapshot of the SBI Dividend Yield Fund NFO. Scroll down further, and we'll give you our opinion on whether to invest.

What are dividend yield mutual funds

Dividend yield funds primarily invest in companies that provide regular dividends at a higher rate than a specified benchmark index.

In SBI's case, they aim to achieve a total dividend yield that is at least 50 per cent higher than the Nifty 50 index.

The four selling points of dividend yield funds are as follows:

- Investors like payouts in the form of regular dividends.

- Dividend yield funds invest in companies that have strong cash flows and large piles of retained earnings.

- Dividend yield funds look at companies whose stock price is attractively valued.

- Dividend yield funds are tax-efficient compared to traditional withdrawal plans. (Dividends received from individual stocks are added to your annual income and taxed as per your income tax slab).

However, let's see if these theories work in the Indian context.

Should you invest

Placing bet on long-term duds

In the last ten years, dividend yield funds have placed almost one-fifth of their money in public sector undertakings (PSUs). While PSUs have fared well over the last 12 months, they have been serial underachievers over a 10-year period.

Average to disappointing returns

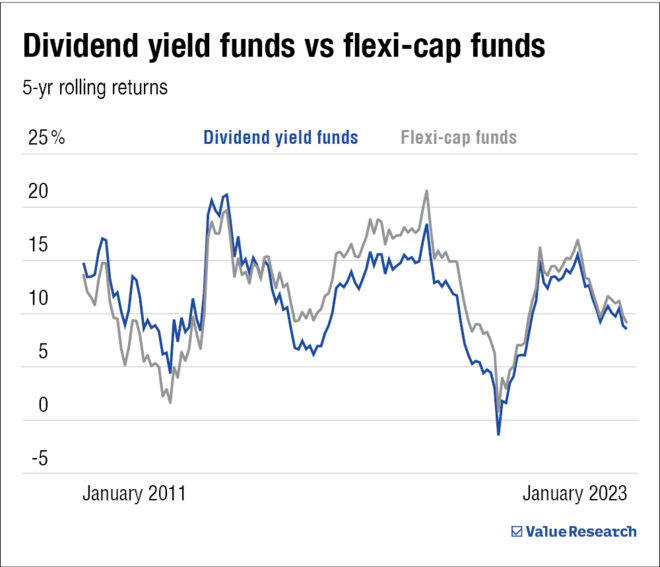

As you can see in the accompanying graph, dividend yield funds have rarely outperformed flexi-cap funds over a five-year period.

No cushion for tough times

Fans of dividend yield funds say they can protect you from market volatility. In other words, these funds fall less during market downturns. But the data doesn't back this theory.

In fact, barring 2011, these funds have performed worse than flexi-cap funds when markets go cold.

Fairly young fund manager

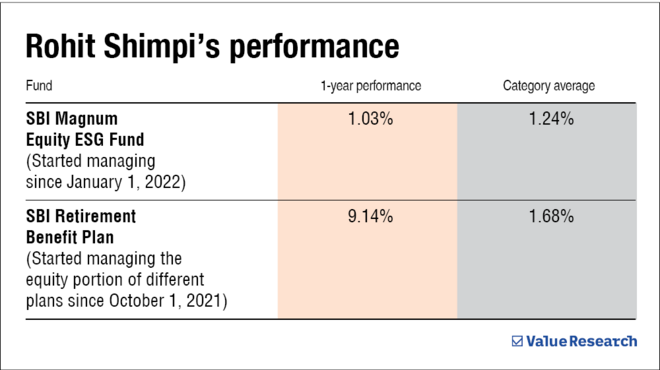

SBI's new dividend yield fund will be managed by CFA Rohit Shimpi. Although he has been managing and advising SBI Fund Management's equity portfolios since March 2011, he started managing mutual funds roughly 18 months back.

While it would be unwise to judge a fund manager based on their one-year performance, Shimpi's performance is a mixed bag.

What you should do

- Safety-first investors may find dividend yield funds to be their natural habitat. But the graph, titled Dividend yield funds vs flexi-cap funds, highlights this fatal fallacy.

- Instead, invest in flexi-cap funds. In addition to being less volatile, these funds have a broader mandate. They invest in companies across different sectors, thereby reducing risk in the long run.

- Dividend yield funds are tax-efficient when compared to buying individual stocks. That said, taxation rules are the same when you compare it with flexi-cap funds.