It is hard to separate the rise of One97 Communications, i.e., Paytm, from the story of digital India. From a simple platform to recharge your mobile phones and DTH, the company became the nation's go-to platform for digital payments.

But as the company grew, so grew its product offerings and the complexity of its business model.

So in this story, we shed some light on how Paytm brings in the moolah.

How Paytm earns money

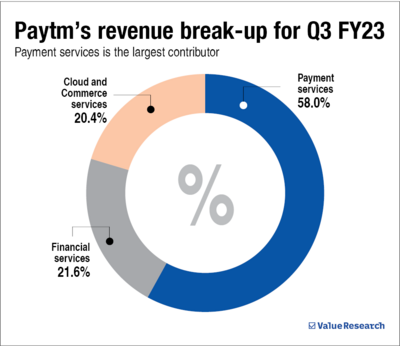

At present, Paytm has three primary revenue sources: payment services, financial services and commerce and cloud-based services.

Payment Services

As you may know, Paytm started off as a mobile and DTH recharge platform. Later on, it expanded its payment services to bill payments and UPI transactions. Given that this has been the company's oldest segment, it is not surprising that it is also the largest revenue contributor. In Q3 FY23, the payment services segment accounted for nearly 58 per cent of the company's overall revenue.

But the question is how it earns from these services.

Every time you recharge your DTH or mobile or pay a bill, Paytm charges a convenience fee. Also, the service providers, such as telecom or discom companies, are charged a fee.

It also offers various subscription-based services to merchants, such as payment gateway services, all-in-one POS devices and Paytm Soundbox 3.0.

Financial services

If you open the Paytm app right this moment, you will find some advertisements offering you a loan, which is quite surprising given that Paytm is not a bank or NBFC.

Actually, Paytm does not offer these loans from its own pocket. Rather it acts as a middleman between financial institutions and consumers.

Its primary task is sourcing and collection. In simple terms, Paytm provides banks with consumers seeking loans. Banks conduct the underwriting process and provide loans. And once the loan is disbursed, Paytm procures the repayments from the consumers and gives them to the banks.

For the above, Paytm charges sourcing and collection fees from financial institutions.

Apart from loans, Paytm also offers sourcing and collection services for other financial products like insurance and mutual funds.

Commerce and cloud services

Apart from the above two segments, a considerable chunk of its revenue flows in from its commerce and cloud services. In Q3 FY23, this segment contributed 20.4 per cent to the topline.

Its commerce services include air tickets, entertainment tickets (movies, concerts), food delivery etc. If it can be bought online, you can pay for it through Paytm. In return, consumers and merchant partners (airlines, food aggregator apps, etc.) pay a transaction fee.

In its cloud services segment, it primarily earns from subscription fees. It runs advertisement campaigns for merchants, app developers, etc., and charges based on the scale of the campaign. In addition, the company also partners with various banks for co-branded credit cards (such as Paytm HDFC credit card).

What lies ahead

From the above, it is quite clear that Paytm wants to be one pit stop for all your payment needs. And to some extent, it is already that.

However, this pursuit of a super app status is costing the company dearly. The harsh reality remains that the company isn't profitable, and they posted a loss of Rs 392 crore in Q3 FY23.