I have switched my earlier funds to a single new hybrid fund in SBI for SWP. What will be the tax implication if I start SWP in the next month itself? Is the entire amount of SWP taxable? Is it TDS? - Anonymous

Mutual funds are subject to tax (capital gains tax) upon redemption, and the taxation of mutual funds depends on the holding period and the type of fund, whether it's an equity or non-equity fund.

With a systematic withdrawal plan (SWP), you can gradually redeem (or withdraw from) your mutual fund investment in a phased manner. It is the opposite of systematic investment plan (SIP) where you invest a fixed amount of money in a mutual fund scheme regularly. SWP reduces the risk of exiting your entire equity investments when the market is down. It averages the redemption price, similar to how SIP averages the purchase cost. It can also be helpful in setting up a regular income plan for retirees. The redemption proceeds are credited to your registered bank account.

Tax implications in case of SWP

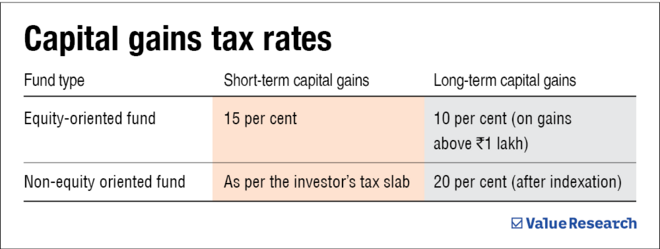

The taxation rules remain the same and depend on whether the fund is an equity or non-equity fund. Funds that invest a minimum of 65 per cent in domestic equities are considered equity funds, and the others are called non-equity funds. Here is how they are taxed:

- Equity-oriented funds: Gains on investments withdrawn within 12 months are treated as short-term capital gains and taxed at 15 per cent. Gains on investments withdrawn after 12 months are treated as long-term capital gains and taxed at 10 per cent. Long-term capital gains on equities of up to Rs 1 lakh are exempt from taxation every financial year.

- Non-equity-oriented funds: Gains on investments held for more than three years are treated as long-term capital gains and taxed at 20 per cent after providing the benefit of indexation. If sold within three years, the gains are added to the taxable income and taxed as per the applicable slab.

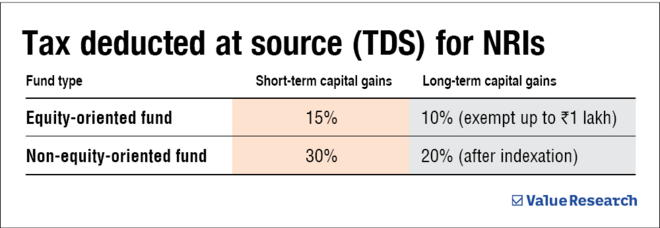

If the investment was made over a period, such as in the case of SIPs, the first-in-first-out (FIFO) method is considered. The units bought first are assumed to be redeemed first. However, debt funds and equity funds have different tax structures. While tax deducted at source (TDS) is not applicable for residents, it is for NRIs.

Remember that some mutual funds, such as ELSS, might have a lock-in period of three years. Consider this while making withdrawals.

To make tax calculation easy, you can visit 'My Investments' on Value Research Online, upload your investments (which is automatic and hassle-free), and get your tax report.

Suggested read: How your mutual fund gains are taxed