You have put your money into a business. It is natural that you would want to know what's your cut in its profits. EPS (earnings per share) is a helpful metric in that regard, as it represents how much money a company makes per share. It is obtained by dividing a company's net profit by its number of outstanding shares.

However, here lies the issue. What if the number of outstanding shares increases?

Companies often issue convertible securities (convertible bonds, convertible preferred stocks, employee stock options, warrants, etc.) to raise capital. In simple terms, these are securities which can be converted into common stock after a specific date or an event. This means there's always a potential risk that the number of outstanding shares will increase and lower the EPS.

To circumvent this, analysts calculate diluted EPS. In diluted EPS, convertible securities are considered in addition to the current number of outstanding shares. For example, suppose Company A has 10,00,000 outstanding shares and reported a net profit (or profit after tax) of Rs 80 crore. Thus, its EPS is Rs 80. But say the company has issued convertible securities that will increase the number of outstanding shares to 12,00,000 once executed.

Therefore, its diluted EPS is about Rs 67 (Rs 80 crore/12,00,000).

EPS vs diluted EPS

Investors should note that the above does not mean that EPS should be disregarded. EPS is indeed an efficient metric for gauging a company's profitability. However, diluted EPS provides investors with a worst-case scenario of how thin their slice might get from the company's profit pie. If the difference between EPS and diluted EPS is large, it means a huge chunk of the company's profit might become unavailable to present shareholders in the future.

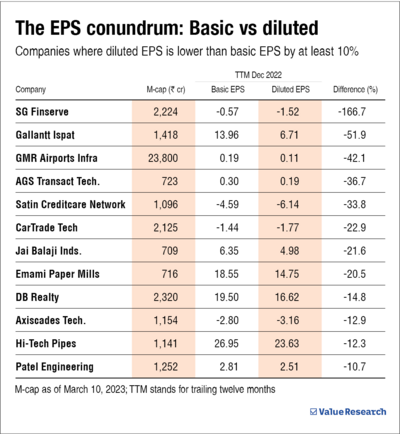

Here are some companies with a significant gap between their EPS and diluted EPS.

Suggested read:

Adjusted EBITDA: Financial doping for loss makers

Look at the EPS, not just profits