SEBI's recent crackdown on the pump-and-dump schemes on YouTube has laid bare open what analysts have worried about for many years - The influence of social media on markets.

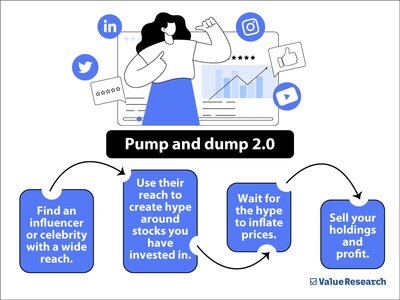

Pump and dump schemes are nothing new. You find duds, create hype around them, wait for investors to buy into the hype and inflate prices, and then sell your positions and profit. The recipe has remained unchanged for decades.

But what has changed is the ease of creating hype. Social media has birthed what some might call "pump and dump 2.0".

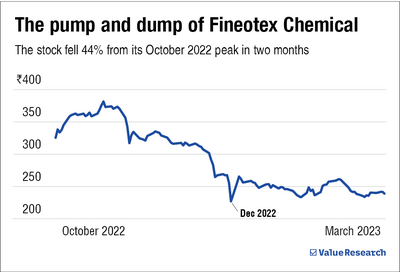

A prime example of this scheme would be Fineotex Chemical. Beginning in September 2022, many influencers (or "finfluencers" as they term themselves) started creating a lot of buzz around Fineotex Chemical being a potential multibagger. Unsurprisingly, given the trust these influencers command from their fans, investors flocked to buy the stock in bulk. This pushed up the price to a yearly high of Rs 392 around October 2022 and made investors feel they made the right call.

But it was all smoke and mirrors. The people behind the scenes funding these influencers and the influencers themselves saw they had hit the jackpot. They exited their positions at this peak, profiting massively and sparking a sell-off that pummelled the stock prices. By December 2022, the stock had declined by 44 per cent to Rs 219.

The worst part is unsuspecting investors believed this was just the usual market volatility and nothing more sinister was at play. And Fineotex Chemical is just one example. Kothari Sugars and Chemicals, RPG Life Sciences, Shyam Century - the list goes on.

What are the safeguards against such schemes?

SEBI has strict laws against any form of stock price manipulation. It tracks any form of irregular transaction activities using its Data Warehousing and Business Intelligence System (DWBIS).

However, the real issue is not the lack of laws but rather the misinformation being spread by influencers. For example, an "investing guru" with over 2,50,000 followers recently advised that any stock trading at a P/E of less than 20 times is a good buy, which, as you might know, is ridiculous. The P/E ratio by itself should never be a trigger for you to invest, and whether it is high or low depends on the industry average.

While a crackdown on such misinformation is needed, formulating a concrete definition of what constitutes financial misinformation can be difficult. This has allowed such scams to thrive despite various failsafe in place by SEBI.

What you should do

Be vigilant, do the due diligence and be boring. The age-old advice of thoroughly researching a company, from its finances and past performance to its growth prospects, has been reiterated over the years for a reason. Your investments should solely depend on your risk appetite and research, not your faith in your favourite influencer or the Twitter buzz.

Investors should note we are not saying all influencers are trying to spread misinformation. Social media can be a useful tool when researching potential investment opportunities. However, the final call should only depend on your own judgement.

Suggested read: Not quite black and white