There's a good reason you are looking to 'invest' in an insurance plan before April 1. Since all insurance plans with annual premiums over Rs 5 lakh purchased on or after April 1 will be taxed (for ULIPs, premiums above Rs 2.5 lakh are taxable), it makes all the sense in the world to look for one. At the same time, it doesn't either.

Here's why: don't treat insurance as an investment. Repeat, don't treat insurance as an investment.

While insurance companies and their 'enthu cutlet' agents might tell you otherwise and try to sell you insurance plans that offer 'returns' after a certain period, we strongly suggest you stick to the good-old pure term plans.

Buy term plans only

Term plans are cheap, effective and will meet your loved ones' needs in case of untimely demise.

Hence, coming back to the central question of this article: no, it does not make sense to 'invest' in an insurance plan before April.

Performance of insurance plans offering returns

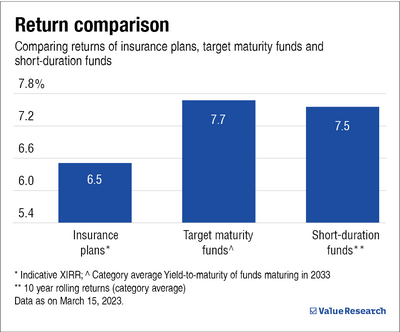

Leaving the insurance part aside and assuming you buy an insurance policy as an investment, the guaranteed return plans deliver only about 6.5 per cent.

For proof, we considered guaranteed return insurance plans of three companies - HDFC Life, Max Life and Canara HSBC Life Insurance. And here's what we found:

- Canara HSBC Life Insurance Flexi iAchieve: The total policy term is 15 years, where you'd pay Rs 1 lakh every year for the next 10 years and receive a total income of Rs 19.44 lakh over the next five years. This includes a guaranteed sum of the initial investment of Rs 10 lakh, Rs 1.49 lakh every year for the rest of the five years and a 'High Premium Addition' of Rs 1.96 lakh.

- HDFC Life Sanchay Plus: The policy term is 25 years, wherein you'd invest Rs 1 lakh every year for 12 years. After that, you'd receive Rs 27.24 lakh in return between years 14 and 25 in 12 equal instalments.

- Max Life Smart Wealth: The policy term is 25 years, wherein you'd invest Rs 1 lakh for the first 11 years, and you'll receive an income benefit of Rs 2.07 lakh every year from year 14 to 25.

These three schemes' median returns (XIRR) turn out to be around 6.5 per cent.

The second drawback is their liquidity. Since these insurance policies have 15- to 25-year contracts, withdrawing your money prematurely attracts heavy penalties.

What you can do

Just to reiterate, if your sole motive is to insure your loved ones, buy a term plan only. No ULIP, no moneyback, no endowment policy...nothing.

But if your sole motive is to invest, we'd suggest you consider either target-maturity funds (TMF) or short-duration funds.

4 Million+ copies sold! Get investment insights, market guidance, fund analysis, data stories, case studies and more. Subscribe to our digital & print magazine - Mutual Fund Insight.

Target-maturity funds

are a type of debt funds.

Short-duration funds

are also a type of debt funds.

The taxes aren't very harsh either. Even though on paper, gains on holding these funds for over three years are taxed at 20 per cent, it is not actually 20 per cent in reality. That's because the initial purchase cost is adjusted for inflation, which greatly reduces your tax outgo.

What you should do

Having said that, investing in a fixed-income option for five, 10 or 15 years is not ideal.

Instead, we'd recommend you opt for aggressive hybrid funds - even if you are a relatively safe investor.

Since these funds invest about 70 per cent in equities and the rest in fixed-income, you will get the best of both worlds.

While equities have historically provided inflation-beating returns over longer time frames, fixed income can cushion the downfall during a market crash.

Its 10-year returns are rock-solid evidence. On average, aggressive hybrid funds have delivered over 12 per cent returns over the last 10 years. Even if you consider taxes, it is still much more than what you would receive from TMFs, short-duration funds and, most importantly, insurance policies that hide under the garb of investments!

Suggested read: Unhappy with your life insurance policy? Here's how you can surrender