Do you remember when we wrote that whole article about Zomato and its adjusted EBITDA after their results? It's only fair that we give some attention to other companies too, right? I mean, have you heard about all these banking disasters going on in different countries? Like, seriously, even big players like Silicon Valley Bank, Signature Bank, and Credit Suisse are all struggling. Can you believe that if you had invested Rs 1,000 in Credit Suisse in March 2018, you'd only have Rs 117 now? That's an 88% loss! It's crazy to think that banks are supposed to be the foundation of a country's economy, but they're the ones always needing bailouts. We talked so much crap about Indian banks, but at least they haven't crashed as bad as these ones (knock on wood).

We are starting to notice a pattern here. The next time you see a Forbes magazine, immediately start investigating that person or company, because chances are that they may fall into this pattern.

That, kind of, sums it up, doesn't it? We thought it was just SVB but no, they had to prove us wrong.

When 2020 started, everyone said how we are going to experience the roaring 20s. COVID, inflation, supply chain, Russia-Ukraine war, and now banking crisis. Generally these events should have been spread through four to five generations, but guess we got the jackpot.

When the entire system is collapsing and the market is down but you know which companies are fundamentally good so you accumulate them. Feels too good to say that, right? Anyway, I just bought 50 shares of Adani Green.

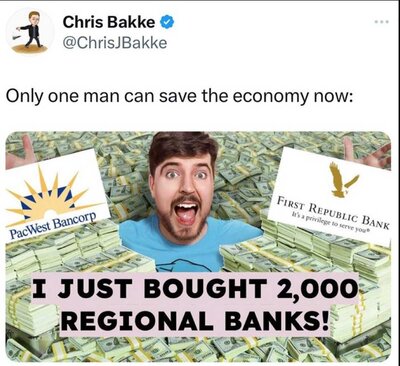

After reading that HSBC paid 1 Pound to acquire SVB's UK arm, we are sure that Mr Beast, with his money and popularity, can save the entire sector.

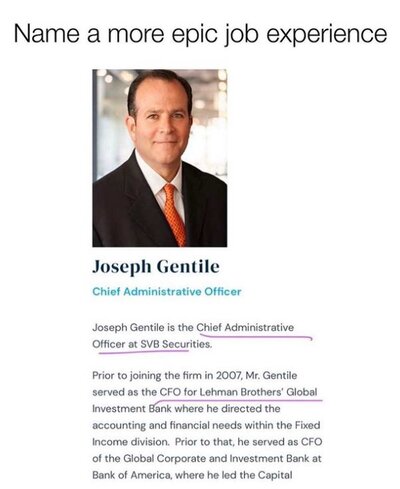

Also, did you know that the Chairman of Credit Suisse is Alex P Lehman? What is it with this name and banking sector? If someone works in a Bank with the name Lehman, just be extra careful.

Ironic, isn't it? A month ago when they said that they wouldn't accept Adani bonds, we thought highly of them and assumed their due diligence was sky high only for them to collapse 30 days later.