Long-term capital gains - mutual fund sale: If the gain is less than Rs 1 lakh, I understand no tax to be paid, do I need to report this during the return file or no need to mention it? - Anonymous

You must report your capital gains if you are required to file a tax return. But, there's more to it.

If you hold equity investments, such as listed shares or mutual fund units, for more than a year, the gains on them are classified as long-term capital gains. Long-term capital gains are exempt up to Rs 1 lakh, and gains beyond that are taxed at 10 per cent.

In terms of reporting these gains in your income tax return (ITR), they must be reported if you are required to file a tax return. In fact, this information is pre-filled in your tax return if it appears in your annual information statement (AIS).

The only exception where you can avoid reporting these gains is if you are not required to file a tax return, which is the case if your gross total income is less than the basic exemption limit applicable to you. The basic exemption limits under the old tax regime are Rs 3 lakh for senior citizens, Rs 5 lakh for super senior citizens, and Rs 2.5 lakh for others. Under the new tax regime, it is Rs 2.5 lakh for all.

If you have not fully utilised your basic exemption limit, the unused portion can be used to reduce the taxable portion of capital gains, whether they are long-term or short-term.

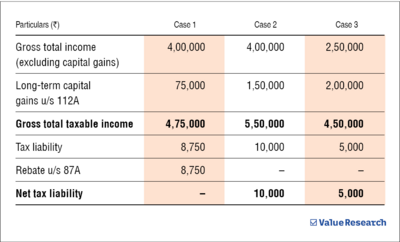

For better understanding, let's consider three different scenarios assuming the basic exemption limit applicable to you is Rs 3 lakh:

In case 1, since your taxable income is less than Rs 5 lakh, you are eligible for a rebate u/s 87A, and your tax liability is nil.

In case 2, your taxable income has crossed Rs 5 lakh, so the rebate is no longer available. You are taxed at slab rates for normal income [5 per cent of (4,00,000 - 3,00,000) = Rs 5,000] and long-term capital gains at 10 per cent for gains in excess of Rs 1 lakh [10 per cent of (1,50,000 - 1,00,000) = Rs 5,000].

In case 3, your taxable income is less than the basic exemption limit, and your long-term capital gains exceed Rs 1 lakh. Here, the unused portion of the basic exemption limit, i.e., Rs 50,000 (3,00,000 - 2,50,000), can be used to reduce your taxable portion of long-term capital gains to Rs 50,000, on which you will have to pay 10 per cent tax, i.e., Rs 5,000.

Capital gains have to be reported in all the above three cases.

Suggested read: How to show equity mutual fund investments in ITR?