Did you know the National Pension Scheme - yes, the retirement savings scheme that also backs up as an additional tax-saver - has a Tier 2 option that is very similar to a mutual fund? Hence the reason we'll compare NPS Tier 2 with mutual funds on several parameters to help you make an educated investment decision.

But before we compare them with mutual funds, we must inform you that it is only available to subscribers of NPS Tier 1 - the investment that helps you save tax under the old tax regime. Now that we have explained their eligibility rules, let's dig deep and compare NPS Tier 2 with mutual funds.

Performance

Here are a few things you should know when we compare their performance:

- NPS Tier 2 has an equity component. It majorly invests in large-cap stocks, so we have matched its performance with large-cap equity funds.

- NPS Tier 2's corporate bond portion has been pitted with short-duration funds and corporate bond funds.

- NPS Tier 2's government securities scheme is directly compared with gilt funds and gilt with 10-year constant maturity funds.

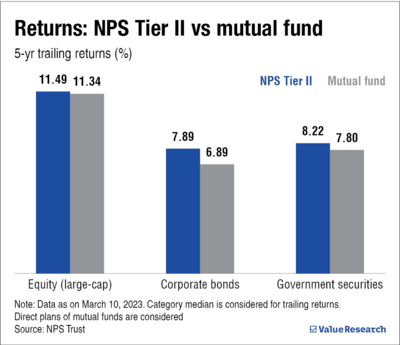

Based on five-year trailing returns

Trailing returns measures an investment's returns between two particular dates. In this case, it is between March 10, 2018, to March 10, 2023.

If you look at the 'Returns' table, NPS Tier 2 schemes have outperformed mutual funds by 1 per cent over the last five years.

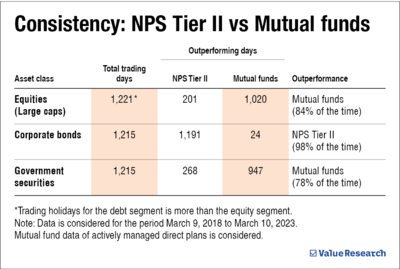

Based on five-year rolling returns

Making a decision based on one data point (return between one set of two dates) as in the case of trailing returns may not be wise. One should check more than one set to gauge consistency. And that is where rolling returns help.

In this case, mutual funds have had the upper hand in their equity and government security investments. As you can see in the table titled 'Consistency', mutual funds' large-cap equity investments have outperformed their Tier 2 colleagues in 84 per cent of trading days in the last five years. Only in the corporate bond segment have NPS Tier 2 consistently outperformed mutual funds.

Do you want to look at how different schemes of NPS Tier 2 perform? Head over to the page here.

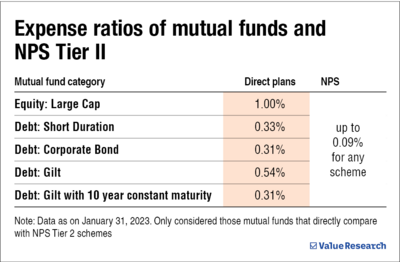

Cost

NPS Tier 2 is more cost-effective than mutual funds. Its expense ratio doesn't go beyond 0.09 per cent. By contrast, 'direct' mutual funds' expense ratio ranges from 0.3-1 per cent. And if you take 'regular' mutual funds into account, the expense ratio is even higher, ranging from 0.6 to 2.3 per cent.

However, NPS Tier 2 has additional costs in the shape of transaction charges. They range from Rs 3.75 (charge per transaction) to 0.5 per cent on subsequent charges (minimum of Rs 30 and maximum of Rs 25,000 if you open NPS through an intermediary).

4 Million+ copies sold! Get investment insights, market guidance, fund analysis, data stories, case studies and more. Subscribe to our digital & print magazine - Mutual Fund Insight.

Ease of transaction

The investment and withdrawal process for both mutual funds and Tier 2 schemes are available online and offline. No additional documentation is needed for the online process.

That said, NPS Tier 2 withdrawal process takes a day longer. They disburse the withdrawal amount on a T+3 days basis, while mutual funds have a T+2 days settlement cycle. Here, T is the day on which you placed your withdrawal request.

Taxation on withdrawals and maturity

There's ambiguity on taxation on NPS gains. But since NPS does not invite an STT (securities transaction tax), most accountants view NPS Tier 2 as a debt fund. So, if you withdraw your investment before three years, the gains would be added to your annual income and then taxed as per the tax slab

rate. But if you withdraw money after three years, you'd be taxed at 20 per cent with indexation benefits. Indexation takes inflation into account, which means it helps reduce your final tax burden.

Naturally, since NPS Tier 2 schemes are viewed as debt mutual funds, the tax treatment of the latter would be the same. However, it's different for equity-oriented mutual funds. In their case, gains are taxed at 15 per cent if you withdraw your investment before 12 months. And if you exit after a year, the tax liability reduces to 10 per cent. Remember that the tax only applies if your gains exceed Rs 1 lakh.

Others

- Flexibility

- NPS investors can change the fund manager once and tweak the asset allocation four times in a financial year without attracting capital gains tax or any other charges. On the other hand, changing mutual funds attract capital gains tax.

- Age

- Mutual funds don't have any age constraints. People under 18 can invest under a guardian. However, NPS is only accessible to people between 18 and 70.

- Yearly contribution

- NPS subscribers are required to make a minimum investment of Rs 250 every financial year to keep the account active. There is no such requirement in mutual funds.

Also read: Is the contribution to LIC Pension Fund under NPS eligible for tax saving?