Debt funds have been hit hard, as it has been separated from their long-standing friend - indexation, a concept that reduced an investor's tax burden.

By removing indexation, the government has changed the tax treatment of debt funds.

What's changed?

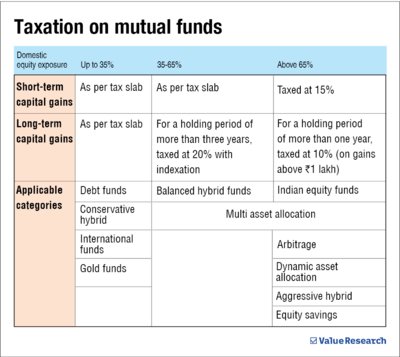

Earlier, if you sold your debt fund within three years, the gain was added to your income and was taxed as per your slab. For investments beyond three years, it was taxed at 20 per cent after providing the benefit of indexation.

According to the amended Finance Bill, the gains from mutual funds with less than 35 per cent equity exposure (effectively debt funds, gold funds and international funds) will not be subjected to indexation anymore. Instead, all the gains will get added to your income that year and be taxed at your tax slab.

This is a disappointing development.

Indexation worked well for investors in reducing the impact of inflation on their investments. Let's say you had invested Rs 5 lakh in a short-duration fund in 2019, and it gave you a return of 7 per cent per annum. After four years, your fund's worth would be about Rs 6.55 lakh.

Under the new rules, a person in the 30 per cent tax bracket will end up paying about Rs 46,000 in taxes. But in the indexation era, the tax outgo (at 20 per cent) would have been around Rs 12,000 only - nearly Rs 34,000 less.

Put simply, investors falling under the higher tax bracket will have to shell out higher taxes under the new rules.

What you should do

Clearly, this is a discouraging development as far as fixed-income investors are concerned. Having said that, don't panic and act in haste.

The new rules apply only to fresh investments made on or after April 1, 2023. Existing investments will not be impacted.

Meanwhile, if you were planning to invest in fixed-income funds, we'd recommend you invest it before March 31, 2023, in order to get beneficial tax treatment. That's because as per the finance bill, debt funds purchased on or after April 1, 2023, will come under the new tax law.

You can get our CEO - Mr Dhirendra Kumar's views on this development here and here.