The Finance Bill 2023 has offered a marginal relief for followers of the new tax regime, reducing the tax liability for individuals whose taxable income marginally exceeds Rs 7 lakh. This measure will benefit individuals with an annual income between Rs 7.5 lakh and Rs 7.78 lakh.

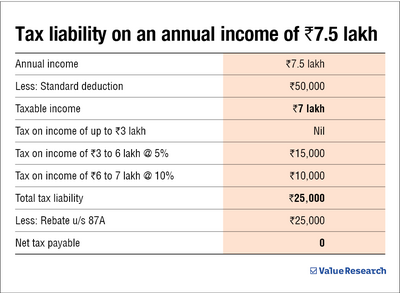

To calculate tax liability, a standard deduction of Rs 50,000 is first subtracted, and then the tax liability is calculated based on the slab. Income up to Rs 3 lakh is exempt from taxation, and a 5 per cent tax is charged on income from Rs 3 to 6 lakh (Rs 15,000). For income between Rs 6 to 7 lakh, a 10 per cent tax is charged (Rs 10,000). This results in a total tax liability of Rs 25,000.

However, if taxable income, after the standard deduction, does not exceed Rs 7 lakh, the individual pays zero tax and can claim a rebate of up to Rs 25,000 under Section 87A of the Income Tax Act. This rebate is only available for taxable incomes on Rs 7 lakh and below.

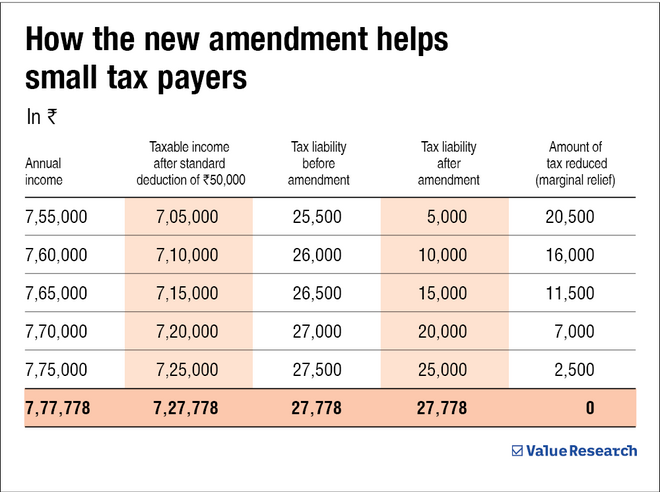

Previously, individuals with slightly higher taxable incomes than Rs 7 lakh had to pay significantly more in taxes, as seen in the example of someone with a taxable income of Rs 7.05 lakh paying Rs 25,500 in tax. Seems like a severe punishment for someone earning only an additional Rs 5,000. To address this, the government has amended the Finance Bill 2023 to reduce the tax liability in such cases. The tax liability will now be the lower of the tax calculated as per the slab or the amount by which taxable income exceeds Rs 7 lakh. For instance, the tax liability on a taxable income of Rs 7.05 lakh would be only Rs 5,000, instead of Rs 25,500. This benefit breaks even at an annual income of Rs 7.78 lakh.

Overall, the marginal relief for the new tax regime is a welcome move that will benefit tax-payers with an annual income between Rs 7.5 lakh and Rs 7.8 lakh.

Suggested read: Indexation benefit is gone, debt funds lose tax advantage