Debt funds investing in Additional Tier 1 (AT1) bonds will likely undergo significant changes from April 1, 2023.

Why?

Because AT1 bonds will be treated as 100-year bonds, they will be exposed to interest rate risks, making them extremely volatile.

That's because there's an inverse relationship between bond yield and price. If the bond price falls, its yield goes up. In that case, the NAV of your debt fund will fall too because it derives its value from the price of the bonds it holds.

Also bear in mind that higher the bond maturity, the higher is the impact. Given that AT1 will be treated as 100-year instruments, any fall in bond price would be damaging for them, something echoed by Sandeep Bagla, the CEO of TRUST AMC: "I think there will be volatility in the yields of these bonds."

Bagla also feels their demand will nosedive. "Liquidity is likely to come down in AT1 bonds due to their valuations... fund houses might not invest in such bonds going forward."

Which fund houses are exposed to AT1 bonds?

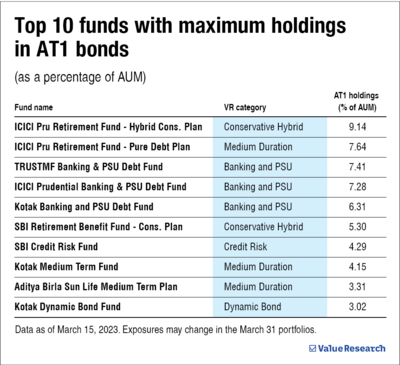

As on March 15, 2023, AT1 bonds were part of a few schemes belonging to ICICI Prudential MF, TRUST MF, Kotak MF, SBI MF, and Aditya Birla Sun Life MF.

What are AT-1 bonds, though?

Banks issue AT1 bonds to raise money to ensure they have the necessary capital stipulated by Basel III norms.

These bonds are called perpetuals because they have no maturity date. The change in maturity is from a valuation perspective for mutual fund houses.

4 Million+ copies sold! Get investment insights, market guidance, fund analysis, data stories, case studies and more. Subscribe to our digital & print magazine - Mutual Fund Insight.

Here are four things you should know about AT1 bonds:

- Have always been relatively riskier than other instruments since a bank can write them off completely if it lands into financial trouble (something that played out during the Yes Bank fiasco).

- They offer higher yields.

- The bank (issuer) can decide to skip paying interest

What does Yes Bank have to do with AT1 bonds?

In March 2020, Yes Bank, the then fifth-largest lender in the country, was effectively taken over by the government because it buckled under the heavy weight of bad loans.

As a result, the AT1 bonds offered by Yes Bank were written off, leading to investors across 30 mutual funds losing to the tune of Rs 2,700 crore.

Got it. But why do AT1 bonds have to become 100-year papers from tomorrow?

It's not an overnight story. In fact, it's been stewing ever since the Yes Bank debacle, which is why SEBI, the markets regulator, had unleashed a series of regulations in 2021, including limiting mutual funds' exposure to such bonds.

The regulator also wanted to review the valuation norms of these bonds and treat them as 100-year papers.

But their plan was met with opposition, so they decided to implement it in a phased manner.

At first, fund houses were required to treat AT1 bonds as 10-year papers until March 31, 2022, then as 20-year papers until September 30, 2022, as 30-year instruments for the next six months, and finally as 100-year instruments from April 1, 2023.

Suggested read: Bombay High Court sets aside write-off of Yes Bank AT1 bonds