On March 24th, 2023, a change was made to the taxation of debt funds. An amendment to the Finance Bill 2023 stated that mutual funds with less than 35 per cent exposure in equities will no longer be eligible for indexation benefits.

This change meant that debt funds will no longer enjoy the benefit of indexation.

For those unfamiliar, indexation reduces the tax burden on the investors by taking inflation into account.

Previously, gains from debt funds were adjusted for inflation (reducing the taxable gains) and then taxed at a rate of 20 per cent if sold after three years. However, under the new rules, gains will be added to the investor's taxable income and taxed according to their applicable tax slab rate without any indexation benefit.

However, it is important to note that this new rule only applies to investments made on or after April 1, 2023, while investments made prior will still receive the indexation benefit, regardless of when they are sold.

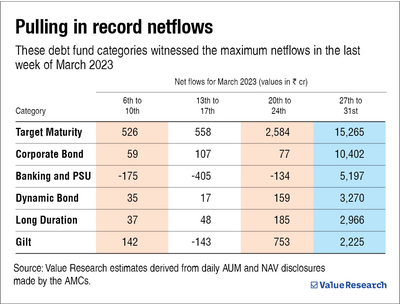

Following this change in taxation, investors poured money into debt mutual funds to lock-in the benefit of indexation. As a result, there was a massive increase in the netflows of debt funds in the last week of March 2023, i.e., from March 27 to March 31.

Here are the top six debt fund categories that have benefited the most from the recent change. The target-maturity fund category tops the list with net flows of almost Rs 15,000 crore, followed by corporate bonds (over Rs 10,000 crore) and banking & PSU category (over Rs 5,000 crore).

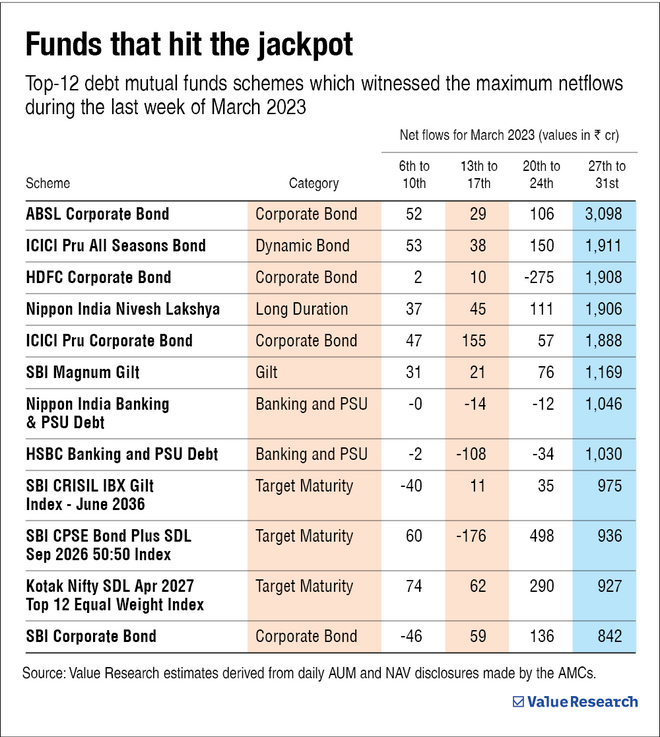

Taking a closer look at the fund level, debt funds from Aditya Birla Sun Life, ICICI Prudential, HDFC, SBI, and Kotak have benefited the most. Aditya Birla Sun Life Corporate Bond Fund alone received net flows of over Rs 3,000 crore. Among the top 12 positions, most holdings belong to corporate bonds and target-maturity funds. Here is the list of the top 12 funds.

Suggested read: The no-indexation rule and our recommended debt funds