Our team here was slightly sceptical if we should do a story on personal loans. "They go against the very fabric of our philosophy," said one. "We encourage people to manage their money in a way so that all their bases are covered. Doing a story on loans will send out mixed signals," said the other.

And we agreed.

But that said, we also realised that there may still be certain situations where one needs extra money. After all, no amount of planning can cover the uncertainties of life.

Hence, our decision to scour the personal loan landscape to ensure it's affordable for you, especially because loans have become costly over the last year (blame the escalating interest rates since last May).

Regular personal loan

The loan amount and the interest you need to pay depends on various factors, such as your income, credit score, employment status and repayment capacity.

How to apply

You can approach your bank physically or online. Once you submit your personal and employment details, the bank will decide whether to approve the loan and on what terms.

What's good

You don't need to put any collateral (property, gold, or any other asset) against the loan.

Once approved, the loan is usually credited to your bank account within a working day.

These days, many financial companies often provide pre-approved loans through mobile apps instantly.

What's bad

High interest rates, ranging between 11 and 24 per cent (because you don't put any collateral).

May have hidden charges. Hence, carefully consider your capacity to repay at a higher interest rate. Also, read the terms and conditions before signing on the document. Bear in mind that even a 1 per cent higher interest rate can make you repay a significantly higher amount.

Loan against mutual funds/stocks

You can take a loan against your investments too. However, you'll have to pledge your mutual fund/stock investments.

The loan amount will depend on the value of securities you have pledged.

If you are an equity mutual fund investor, you'd get loans up to 50 per cent of your investment's value (NAV). Debt fund investors get loans of up to 80 per cent of the value.

The minimum loan amount is Rs 25,000, while the upper limit is Rs 20 lakh for equity fund and stock investors and Rs 5 crore for debt fundholders.

How to apply

Since your KYC process is already done, you don't need to furnish any more documents.

However, you'll need to check if the mutual funds or stocks you own are on the approved list of the loan provider.

You also get the option to choose which mutual funds you want to use as collateral. (Collateral, in this case, are the investments you are agreeing to give to the lender in case you are unable to repay the borrowed amount).

What's good

Quick approval of loan. Money will be credited instantly.

What's not good

The interest rate usually ranges from 9 to 14 per cent.

What's bad

Your investments can be taken over by the lender if you are unable to pay back the loan.

Stock investors should be careful too. If the value of your stock investments falls significantly, you may be required to either pledge more investments.

There may be other terms and conditions involved with loan against stock investments, such as margin requirements, restrictions on the sale or transfer of the pledged securities, and fees and charges.

Credit cards

Credit card loans allow you to borrow money against your available credit limit and credit worthiness.

How to apply

Contact your credit card provider.

What's good

The pace of loan approval depends on your credit score and if you have an account with the bank.

Once approved, the amount gets transferred instantly.

What's bad

High interest rates. They usually range between 11 and 24 per cent.

There may be additional fees too.

Public Provident Fund

Do you put money in PPF? If so, you'd be eligible to get a loan.

There are some eligibility criteria though.

One, the maximum loan you can get is 25 per cent of the PPF balance you had two years before the loan date.

Two, if your PPF investment is between two and five years.

How to apply

- In case you opened a PPF account with India Post, you'll have to visit the branch and fill up a loan-request form. There is no online process.

You'd also have to visit the branch each time you want to repay the loan. - In case you opened PPF with a bank, you have to visit their branch to get a loan. There is no online option.

However, when it comes to paying back the loan, you can simply give them a standing instruction for the loan to be repaid from your savings account. Unlike with India Post, you do not have to go to the bank. - The application process is straightforward, as your KYC process was already done while opening your PPF account.

What's good

The loan is approved instantly. The money is credited within one working day.

The loan interest is just 1 per cent above the prevailing PPF returns. Let's give an example: since PPF is currently providing 7.1 per cent interest, the loan rate would be 1 per cent higher than that, which is 8.1 per cent.

Unlike the previous options, PPF has no hidden charges. What you see is what you get.

What's not so good

You need to repay the loan in three years' time.

If you don't, the loan interest will be bumped from 1 per cent to 6 per cent over and above the prevailing PPF rate. Essentially, the rate for delayed repayment will be 13.1 per cent (7.1 per cent + 6 per cent). Furthermore, this rate will be applied retrospectively from the first month of the loan until the time you fully repay it.

To summarise, PPF offers the most affordable personal loan in the market, especially those who need a small loan and for a short period of time.

Its interest rates are the best-placed among all the four options (provided you repay the loan in time, of course).

But since PPF loans can be availed between two and five years only, the loan against mutual funds/stocks option is relatively better placed than regular personal loans and credit card loans.

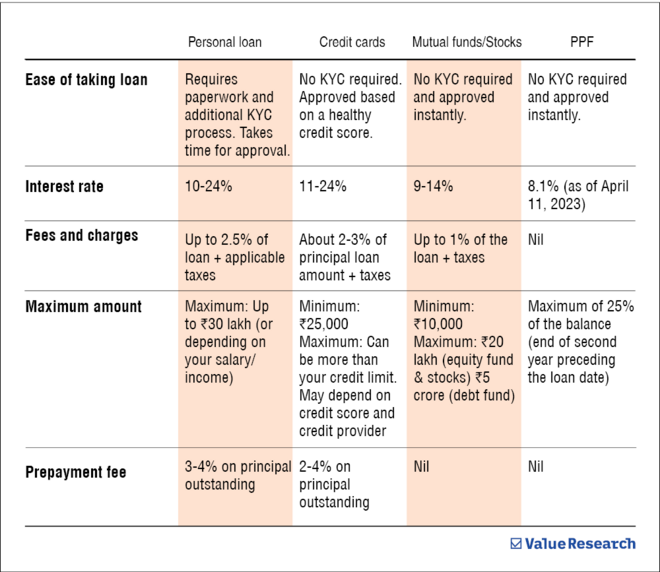

At a glance

Also read: Debit cards and mobile recharges offer up to Rs 10 lakh life cover