Judging by last financial year's trends, we, Indian investors, need to pat ourselves on the back. We kept investing through SIPs (short for systematic investment plans) even when the markets were off-colour.

As per Association of Mutual Funds in India, SIPs saw net inflows of about Rs 1.55 lakh crore net in 2022-23, around Rs 31,000 crore more than the preceding financial year.

That was not the only positive trend. We found three more while going through AMFI's report.

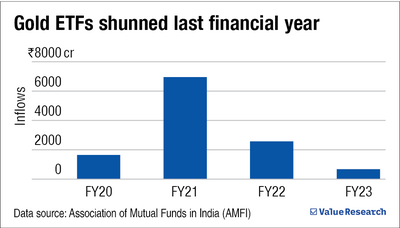

Gold's old

Global economic uncertainties may have driven gold prices around 15 per cent higher last financial year, but there was little investor interest in the precious metal.

Gold ETFs (exchange-traded funds) received inflows of about Rs 652 crore, sharply lower than Rs 2,537 crore in 2021-22 and Rs 6,914 crore in 2020-21. (The 2020-21 period saw a lot of people plough their money in gold ETFs due to the uncertainties sparked by the COVID pandemic).

That's a positive because gold is not a productive asset; it doesn't help you build wealth in the long run. And despite an increase in gold prices in 2022-23, investors didn't fall head over heels over it.

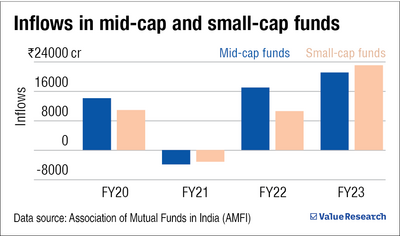

Faith in mid- and small-cap funds

We, at Value Research, have always stated that mid- and small-cap funds are volatile and that the idea of investing in them should only be entertained if you have the stomach to absorb the ups and downs, and have enough time on your side.

That's because such investments tend to do well only in the long run and only if you give your investment at least 5-7 years to grow. In fact, over a ten-year period, mid- and small-cap funds have given returns of 18.21 per cent and 20 per cent, respectively.

Hearteningly, even though the BSE Mid-cap and BSE Small-cap indices declined 0.2 per cent and 4.5 per cent last financial year, respectively, investors stayed patient and showered their love on them.

Net inflows into small-cap funds almost doubled to Rs 10,144 crore in 2022-23, while mid-cap funds saw a roughly 25 per cent increase in net inflows to Rs 20,205 crore.

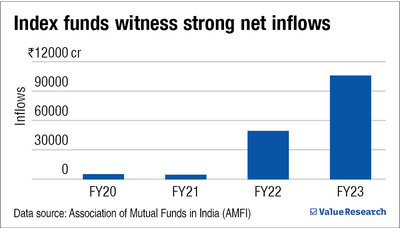

Heavy inflows in index funds

In the last financial year, index funds saw a net inflow of Rs 95,666 crore, out of which 40 per cent of the flows, or Rs 27,228 crore, came in the month of March itself.

The last week of March was mad, thanks to the last-minute change in the Finance Bill. The amended bill took away indexation benefits from mutual funds with less than 35 per cent exposure to equities. This sparked a frenzy among investors. They only had time until March 31 to invest in the impacted mutual funds (for example, debt and international funds). If they bought after the deadline, they'd receive no indexation benefit.

Value Research estimates that target-maturity funds (TMFs) were a big beneficiary, receiving inflows worth Rs 19,228 crore in March itself. This total includes the Rs 1,905 crore that flew in from new fund offers (NFOs).

If that's the case, it's a healthy outcome for investors who were scrambling for risk-averse, long-term options in the last week of March. Healthy because TMFs are somewhat predictable, affordable and less-risky investment option in the debt fund universe. To know more about TMFs, click here.

Suggested read: Debt funds see skyrocketing netflows