"Only two people can buy at the bottom and sell at the top, one is god and the other is a liar". - Vijay Kedia

The retail investors have always been concerned about timing the market. We finally aim to settle this debate that time in the market is more important than timing the market.

To prove our point, we took the BSE Sensex data for the past 10 financial years (FY14-FY23). During this period, there were 2,476 trading days. Had you invested on April 1, 2013 and stayed invested without caring about the market fluctuations till March 31, 2023, you would have comfortably made a return of 12.1 per cent per annum.

However, if you had tried to time the market and missed out on just 1 per cent of the top performing days (25 days), your returns would have been a meagre 1.8 per cent per annum. To give context, just 25 days could make or break your portfolio.

From the above case, we can confidently conclude that time in the market or staying invested in the market is imperative for wealth creation and timing the market incorrectly may lead to wealth erosion.

To prove our point further, we went a step further and checked what would happen if you were able to consistently time the markets correctly?

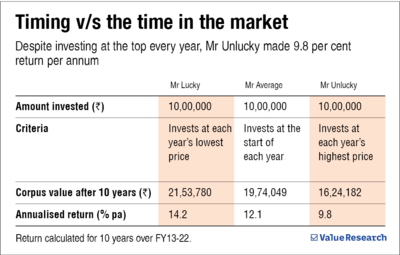

Again, to back us up, we took the BSE Sensex data for the past 10 financial years (FY14-FY23). Now let's consider three individuals - Mr Lucky (always invests at the bottom of the market in a given year), Mr Average (invests on a given date every year) and Mr Unlucky (always invests at the top of the market in a given year).

All three of them invest Rs 1,00,000 every year. Here is what they make:

It is a no brainer to see Mr Lucky make the highest return amongst the three. Since he invested at the bottom every year, he was able to outperform his peers and generate 14.2 per cent per annum. But truth be told, it is impossible to have as good a fortune as Mr Lucky.

On the other hand, if you hadn't applied your brains and would have just invested on the first of every financial year, even then you would have generated a decent 12.1 per cent return per annum.

In conclusion, timing the market is not only difficult but also unnecessary. Our objective as investors is to achieve our financial goals and create wealth, and this can be accomplished by staying invested in the market for the long term. By doing so, we avoid the risk of missing out on the market's top-performing days, which can have a significant impact on our portfolio's performance.