Mutual funds have distinct investment philosophies. Broadly speaking, some bow down to 'growth' style of investing, while others swear by 'value'.

In the growth style, the price of company stock is secondary. The argument is that if a company has performed well in recent years and the future looks bright, it makes sense to invest in them even if their stocks command a higher price. Shreyash Devalkar, senior fund manager at Axis Mutual Fund, explained it succinctly when he sat down with us for an interview on the latest edition of Wealth Insight (May 2023 issue): "Good quality companies typically trade at a premium due to their inherent attributes (faster expansion and earnings growth) and margins of safety."

On the other hand, for mutual funds that follow a value style, the price of the company stock is paramount. They look at companies that are undervalued but have future potential.

There is no better or worse in either case. Both styles have their pros and cons.

Growth pangs

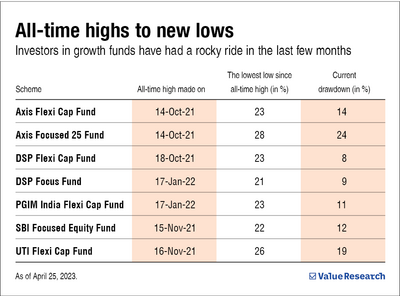

Having said that, mutual funds that follow a growth style have been under severe strain in the last year or so. As you can see in the table, some of the prominent 'growth' mutual funds have taken a solid beating since 2021-end.

Investors who put their money in these funds during all-time highs are still waiting for their investments to recover.

Reason for underperformance

Until around late 2021, 'growth' funds were in the fast lane. They invested in quality companies even if the stock price was on the higher side.

The going was good until the economy started showing signs of weakness.

A weakening economy - when inflation and borrowing rates start ballooning - is not conducive for growth companies.

That's because growth companies need to keep gaining incremental market share.

But rising borrowing rates stall their momentum.

This situation is currently playing out in India as well. With India's borrowing rates and inflation surging sharply in recent months, the fortunes of growth companies and mutual funds that invest in them have taken a nosedive.

The road ahead

Is there an end to growth funds' misery?

Fortunately, there is.

Devalkar, the senior Axis fund manager, says: "Maintaining or improving market share during a slowdown is generally proof of a strong moat. Such companies generally tend to benefit during the upcycle, disproportionately."

In other words, if growth funds can ride out the painful cycle of high inflation and borrowing costs by growing or even consolidating their market share, it can unlock the next phase of prosperity.