Silver prices have gone up since the turn of this year, up 9.5 per cent in 2023 alone. The other thing that's gone up since then is the volume of those advocating silver investing. So much so that one of the dailies recently dubbed the white metal as the "new gold for your portfolio".

So, should you?

We've been here before. There was a false dawn last year as well. Prices went up; silver ETFs were pushed out by fund houses as a viable investment option before the hype eventually fizzled out in a span of a few months.

As reported earlier, silver ETFs fell by 5 to 5.7 per cent last year.

But don't equities also go through ups and downs?

Sure, equity, which is the world's best wealth-creating asset class in the long run, also goes up and down all the time.

But unlike silver, equity is a wealth generator for investors.

Let's look at their 10-year performance to provide evidence.

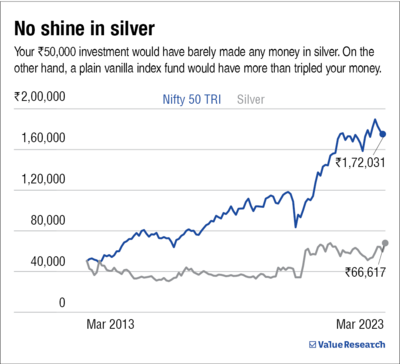

In the last ten years - between April 2013 to March 2023 - the Nifty has surged 13.1 per cent yearly. Basically, if you had invested in a vanilla index fund, your investment would have roughly grown the same.

Silver, meanwhile, pales in comparison, growing a paltry 3.1 per cent in the last 10 years. To give you perspective, if one had invested Rs 50,000 in 2013, the current silver investment would be a mere Rs 67,833, whereas your index fund money would grow more than double to Rs 1.72 lakh.

Fortunately, our seasoned number-crackers have recommended a few index funds for our Premium subscribers. You can visit the section to get the list of our Best Buys.

Our take: Avoid

Silver as a commodity does have wide industrial usage, and there is demand for it from time to time, but that doesn't mean you should eye the white metal from an investment perspective.

As its 10-year history suggests, silver is an unproductive investment option. Moreover, since it's a commodity, its price see-saws depending on the demand and supply at the time.