As investors, improving your investment decision-making skills is a must. Thankfully, the 'Analysis' feature under 'My Investments' can help us exactly with that.

In this article, we'll explore the ins and outs of the 'Analysis' feature and how it can assist you in making informed investment decisions. So let's dive in.

- As the first step, upload your investments with Value Research with just a few clicks. It really is simple!

- Next, log in to your Value Research account.

- Then click on 'My Investments' at the top, and check the 'Analysis' tab.

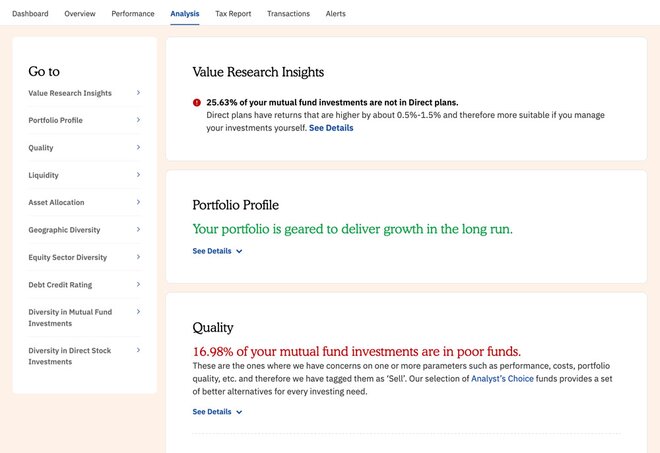

What does the 'Analysis' feature do?

- This tab helps you identify if your investments are well-spread or not. You can accordingly diversify your portfolio well and achieve better returns over time.

- You can use our algorithm-driven insights to make smart investment decisions without being a geek.

The insights on this page are classified under various themes, and here's a brief detail on each.

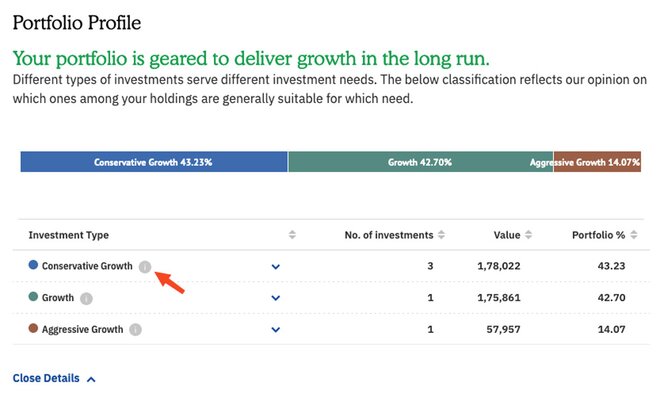

Portfolio profile

This section gives an overview of your investments. Your holdings are classified by the type of investments, and this is done on the basis of the returns and investment horizon. In other words, this is our opinion on which of your investments serve which of your needs.

You will see categories like 'Growth', 'Conservative Growth', ' Aggressive Growth', etc. You will also see what a specific category means when you click the information icon, as shown in the screenshot.

For example, if a majority of your portfolio is 'Growth', your investments are generally geared towards the long-term with a holding period of five years or more.

Quality

This theme indicates the financial health and stability of the fund. They are classified as 'Buy', 'Sell' or 'Avoidable'.

In other words, we give you our take on the good, bad and ugly funds you hold.

A list of some hand-picked funds by our analysts is just a click away in this section. Further, you will know if there's a chance of your stocks experiencing financial distress or bankruptcy.

Liquidity

It will tell you which of your holdings you can exit depending on the lock-in period and type of fund. It also takes into account your exit load. Accordingly, you can make informed choices.

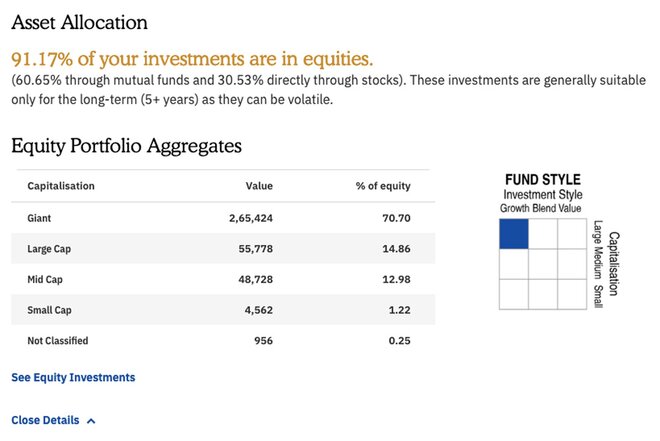

Asset allocation

Here, you see a summary of your investments based on whether they are equity or debt holdings.

The equity section shows you the following:

- The market cap of your investments (large-, mid- or small-cap), and

- Your investment style (growth, blend, or value).

Similarly, the debt section is divided on the basis of fund type. For instance, government securities, bonds, fixed deposits and others. You can see the credit quality of your investments and check the impact of interest rate changes on your investment.

Your fund type and investment style will be shown using a matrix, as can be seen in the screenshot below.

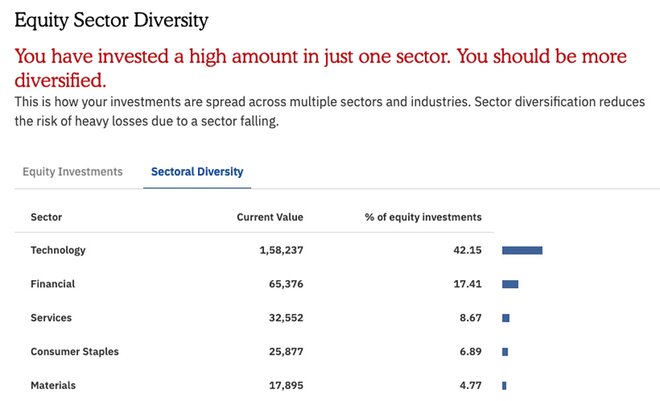

Diversification

This section adds to what you see in asset allocation. You can see how your wealth is currently distributed across geography, sector, and the type of investment. For instance, the screenshot shows diversity according to the sectors.

You can also check if you've concentrated your wealth in a particular area too much.

Similarly, you can seek our customised advice and diversify your portfolio to avoid the excessive impact of market risk.

All in all

- This tool helps you understand your portfolio better.

- It tells you whether your investments are well diversified.

- You receive prompts and advice specific to your portfolio, and much more.

Please be aware that certain features mentioned here are only available to Value Research Premium members. Nevertheless, the free version of the tool offers valuable information that is hard to come by elsewhere. We encourage you to take advantage of the tool's capabilities for a seamless portfolio management experience.