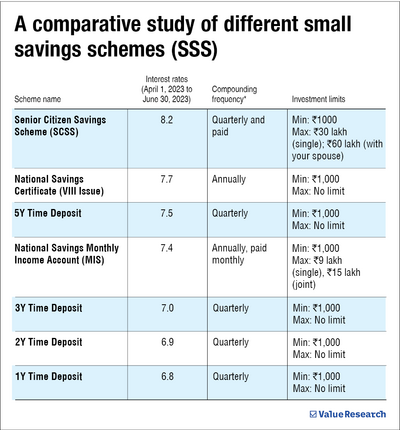

This financial year, the interest rate for small saving schemes (SSS) was increased from 7.6 per cent in December 2022, to 8 per cent in Jan 2023; and finally to 8.2 per cent in April 2023. Senior Citizen Savings Scheme (SCSS) stood out with the highest return. No wonder, it is now a very lucrative option for senior citizens or anyone who wants to help their parents or elderly relatives manage their money. So, here we have answered all the questions regarding this scheme.

Why invest in SCSS

SCSS gives you multiple benefits.

- It's a government scheme. Hence it is safe.

- It has the highest return rate at 8.2 per cent, across small savings schemes (refer to the table for a list of schemes and their returns).

- SCSS provides tax benefits (under Section 80C) on investment amount up to Rs 1.5 lakh.

- The upper investment limit per person is now Rs 30 lakh. This means if you and your spouse are both senior citizens, you can invest up to Rs 60 lakh in total by opening two separate accounts in your and your spouse's name respectively.

Am I eligible

You are eligible if you fulfil one of the given conditions.

- A senior citizen (above 60 years of age).

- Younger than 60, but investing jointly with a spouse who is a senior citizen.

- A retired civilian employee (55 to 60 years of age) or a retired defence employee (50 to 60 years of age) as long as you invest within 1 month of receiving retirement benefits.

Can I open a joint account

- Yes, you can open a joint account but only with a spouse.

- At least one of you has to be over 60 to be eligible for the scheme.

- Whoever is 60 or older will be considered to be the primary account holder.

- There will be no age-limit for the second applicant.

How to open an account

You can open an SCSS account with the nearest branch of a bank or the post office. The post office will ask you to fill the SCSS application form and the bank will provide you with the relevant form as well.

You can also transfer your SCSS account from the post office to a bank of your choice by submitting Form G and relevant documents to the post office.

Tell me about the interest

- You receive the same rate of interest whether you invest in any of the banks or a post office.

- The interest is automatically credited quarterly to your savings account, on the first working day of April, July, October, and January, respectively. Every financial year, investments up to Rs. 1.5 lakh qualify for tax benefit under Section 80C.

- Interest earned on SCSS is taxable If the total interest earned by you in a financial year through all types of deposits is more than Rs 50,000.

Is it possible to add more money to an existing SCSS account

No, you cannot add more money to an existing account. You can open more than one account. However, the total investment in all your SCSS accounts cannot be more than Rs 30 lakh. Also, if your spouse is older than 60 years, they can be the primary account holder in SCSS too, and then together you can invest up to Rs 60 lakh.

How long can I keep my money in SCSS

- The account can be opened for five years, but you can extend it only once for three years.

- You can extend your SCSS account within one year after the date of maturity by using Form 4. If you extend your account after maturity, you earn an interest at the rate applicable to the scheme on the date of maturity.

- If you have already extended your account once, you can open a new account after closing the previous one.

How to withdraw from SCSS?

When withdrawing your money from SCSS, keep in mind the following conditions.

- If you withdraw within one year, you won't get any interest. Your bank or post office will also recover the paid interest from your principal.

- Between one year to two years, 1.5 per cent of the principal will be deducted and the balance will be paid to you.

- Between two to five years, one per cent of the principal will be deducted.

- If you withdraw after the maturity of your account, at the end of the fifth year, without any extension, there is no penalty.

- Also, if you have not extended your account after maturity, and withdraw between year five and year six, you will gain interest rate applicable to the post office savings account.

- Currently, there is no guideline available about whether you can withdraw your money between year five and six. We wrote to the National Savings Institute (NSI) and shall amend the information based on the inputs we receive from them.

- However, if you decide to close your account any time between six to eight years, there is no penalty.

- Note - You will need to submit Form 2 for premature withdrawal of SCSS.

Should I continue my spouse's SCSS account after their death

Only if you're 60 years or more of age. Also, it depends on your circumstances. If you need regular income, you may choose to continue. From a wealth creation perspective though, you may choose to invest the money elsewhere.

- Note that in case of death, there is no penalty on proceeds. The nominee can close the account and claim the proceeds by conducting claim formalities and submitting Form 3. However, only a spouse can continue the SCSS account if they are eligible for it by meeting the age criteria.

- In case of death, please note that the rate of interest is paid as per the scheme till the date of death, and after that, the post office savings account rate till the date of account closure.

Key takeaways

- SCSS is a government-backed income generating scheme with high interest rates where you can invest a significant amount.

- As of the first quarter of FY2024, it has the highest interest rate across all small savings schemes.

- It provides flexibility in terms of premature withdrawal in case of an emergency.

- Most importantly, in the unfortunate event of the account holder's death, the spouse gets unique benefits which are not offered by other schemes.

As a senior citizen, it is certainly an option worth considering for regular income in your golden years.