Volatile does not mean risky, irrespective of what your investment guidebook might be saying. At least, according to the greatest investor of our time, Warren Buffett.

Finance academia firmly believes that if a stock is highly volatile, it is a risky investment. They measure this risk using the beta, a metric that shows the volatility of a stock's price compared to the volatility of the overall market.

And according to them, the higher the beta, the riskier the stock.

However, Buffett disagrees.

In one of his many rewarding seminars, he said, "A wildly fluctuating market means that irrationally low prices will periodically be attached to solid businesses. It is impossible to see how the availability of such prices can be thought of as increasing the hazards for an investor who is totally free to either ignore the market or exploit its folly."

And it's not just empty words. Buffett's experiences in the market have taught him that volatility doesn't equate to risks.

The tale of the Washington Post

Back in 1973, the Washington Post was in peril. Its coverage of the Watergate Scandal led to the resignation of then-US President Richard Nixon. This, coupled with some macro factors, led to the company falling off the market's grace.

Share prices of the Washington Post went haywire, and its beta skyrocketed. So if you looked at the beta and equated it to risk, investing in the Washington Post seemed like inviting financial doom.

But its financials were sound. The company had huge growth potential. And it was trading at a market value of $80 million, while its assets were worth $400 million. Simply put, the company was trading at a huge discount.

So, what did Buffett do?

Buffett paid no heed to the beta and invested in the Washington Post, which turned out to be one of his most rewarding buys.

The Oracle of Omaha has always believed that risk is dependent on a company's financial health, its valuation, and its ability to generate shareholder wealth. How the market feels about a stock at present has little consequence in the long term.

Our findings

While we have faith in Buffett, we wanted to put his beliefs to the test.

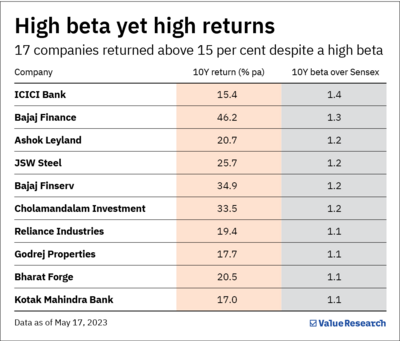

A beta of one indicates that a stock is as volatile as the benchmark index. Hence, academia and many market professionals consider a beta greater than one to be risky (as for them, volatile means risky). Hence, we looked into the BSE 200 index for companies that gave stellar returns despite having a beta of greater than one.

Here are the top 10 companies ranked by their 10Y beta that gave above 15 per cent returns in the past decade.

Your takeaway

We agree with Buffett.

Not because of his legendary status but because we firmly believe volatility is just noise. If you are a long-term investor, such noise makes little difference to your returns. Markets are infamous for looking over wealth creators in the short-term. As investors, we should always be on the lookout for fundamentally strong companies that are selling at discounts.

Suggested read: Seven investing sins