With a state government employee for a father, a homemaker for a mother, as their eldest child, I inherited their financial beliefs. A frugal and responsible mindset, a no-risk attitude, and insecurity and fear; that's what drove our financial decisions.

My parents managed to give all of us a decent education, made a house by the time I was in college, and had a small nest-egg tucked away for a wedding or a higher education, if my siblings or I wanted it. In short, it was going good...or so we thought!

Our naivety

We never considered insurance, neither health nor life. As a government employee, my dad knew we'd be taken care of, should something unforeseen happen to him. Also, the government health facilities were available to us for free, all of them. So, why did we need insurance? Why waste money that could be saved in a fixed deposit?

And then

As Shakespeare once said, "Fortune brings in some boats that are not steered", a call in December, 2011 rocked our family boat and sank our luck. I learnt from my brother that he had met with an accident on the road. That was it.

What seemed like at best a bad fracture and a large wound in his leg, escalated within three days to a life-threatening situation. We rushed to Mumbai because there were better facilities there, and a month later, all hands were on the deck to salvage his leg.

No longer were we eligible for government medical coverage because we were not in the home state where my father was employed.

Fast-forward two years, he recovered, but our finances were stripped to the bones. All we had was our dad's monthly salary.

Numberspeak

Almost 15 lakh rupees of savings and investments were gone. To make matters worse, we had debt. (The only saving grace was that it wasn't a bank loan).

This happened almost 12 years ago.

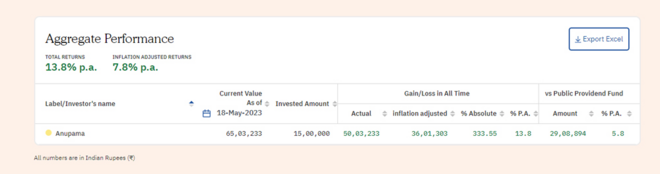

Instead, if we had health insurance in place and invested Rs 15 lakh even in a middling index fund, that amount would have compounded to almost 65 lakh rupees. Even a PPF investment would have grown to 29 lakh rupees. How do I know? I used the 'My Investments' tool on this site!

Oh, and I haven't even included the income loss and its compounding that my brother had to experience during the two years of his treatment. It's taken us 10 years to bounce back to a comfortable situation, but my head still reels at that number - half a crore rupees! Anyways, let's not talk about the ifs anymore...the more I type, the more rotten I feel.

If only we had... At this point, I remember what Morgan Housel says about luck in his bestseller, The Psychology of Money:

"Luck and risk are both(...)driven by the same thing: You are one person in a game with seven billion other people and infinite moving parts. The accidental impact of actions outside of your control can be more consequential than the ones you consciously take."

An accident you see, is exactly that. An action out of our control which had more consequences on our life than any of the actions we took consciously.

My humble suggestion

Please do not wait to be humbled by time. Plan in advance. Get insurance before you even start investing. Health insurance is not just about your mental peace; it's also about various other losses, both monetary and otherwise.

Sometimes, the only thing between financial stability and financial crunch is a medical bill.

Also read: Five smart money moves to make in 2023