The title is catchy - but that was the purpose. And though exceptions catch our eye, this headline isn't really an attention-grabber.

I was at a meeting with a client who shied away from equity since it is a risky asset. He wanted to plan for his retirement and was in his early 40s. However, when I sent him a proposal recommending equity as the best investment option, he was short of telling me to leave the room.

But once the initial needle dissipated, I asked him a couple of questions to give him my perspective. Let's go through how the meeting progressed for the benefit of many who shy away from equity due to the perceived risk associated with it.

- How would you define risk? - In the world of investment, it would mean losing value or incurring a loss. Nobody likes to lose money.

- What is the objective of long-term investment? - To create wealth to maintain, or improve, standard of living.

- How can the standard of living be maintained or improved? - By keeping intact or increasing the purchasing power of money over time. With each passing year, inflation robs a portion of the value of your money. To give you an example, Rs 100 today is worth Rs 11 after 30 years, assuming a 7 per cent inflation. And so clearly, we need a return higher than inflation to be able to improve our standard of living. No one can escape the erosion of capital due to inflation.

- Then come taxes. We need to pay capital gains tax on equity investments when we book profits. If we have interest income, it gets taxed at the marginal rate of taxation (the tax rate applicable as per the Income Tax slabs). Capital gains in debt and dividends get taxed similarly at the marginal rate.

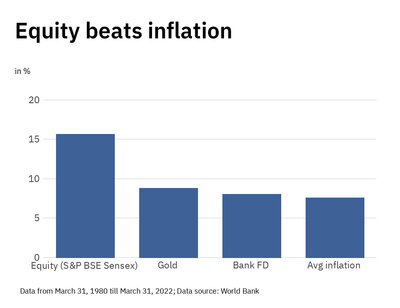

- What is left is a pittance if not invested smartly. Among the financial asset classes, equity beats inflation with the highest margin. Investments in debt and gold just about beat inflation in the long term, but if one considers the taxes to be paid on the small incremental real return, the profit reduces even further.

I have heard clients say they invest long-term money in gold or safe small-savings and invest in equity for the proverbial kick, quick gains, and excitement in the short run. This thought is suicidal on all fronts. It should actually be the reverse, in reality. Short-term money, where we need certainty of income, should be parked in debt, and the long-term investment in equity so that with time, the power of compounding works in your favour.

Misconceived notions

The most misunderstood aspect about equity is that it is considered risky because of its volatility. However, risk and volatility are two separate concepts. Risk means permanent loss of capital and volatility means change in the value of capital. In equity's case, the change in value can often be temporary. But if that still makes you uncomfortable, there are several ways to mitigate it, which I'll discuss now.

Often, clients say they are risk averse and, therefore, cannot stomach the volatility in equity. I agree with the fact that we all are different and do not expect to have similar risk appetite. However, my perspective is that I would rather live with volatility and increase my purchasing power than to erode it with a steady debt investment. And in equity's case, volatility reduces with time. In the history of the sensex, the probability moves towards nil over longer holding periods provided the investments are made in good growing businesses.

Other ways of reducing volatility in equity is to diversify across sectors, market capitalisations and investing in a staggered way. These are strategies to reduce volatility in equity. When people say equity is risky (read volatile) while debt is safe, I agree with them only when they refer to a short period, not otherwise.

And so, what would you call a riskier asset for a client? A safe, steady-growing asset with reducing purchasing power and unfavourable taxes or a volatile asset that would take care of your cash flows once the income stops.

Shyamali has been navigating the asset management world for over 20 years, working with everyone from the seasoned super wealthy to absolute beginners. She has a knack for understanding the human side of investing and empathising with investors, something that shines through in her writing. She can be reached at [email protected]

Also read: Complexity over simplicity