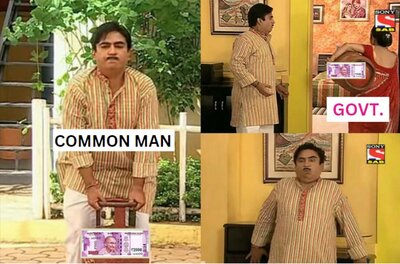

The buzz of the week is the withdrawing of Rs 2,000 denomination banknotes. Introduced with great pomp in 2016, these notes gradually lost their prominence. Initially, it appeared that everyone possessed one, making it a daunting task to find change for them. Even exchanging Rs 500 notes posed a challenge, let alone the struggle with Rs 2,000 notes! However, their circulation dwindled over time, leaving us pondering who still held onto them. Surprisingly, my mother safeguarded a single note for over three years. How many other mothers out there harbour Rs 2,000 notes in their clandestine vault? It feels like embarking on a hidden treasure hunt.

What was once regarded as an insignificant announcement has now gained significance. Food delivery companies are now accepting payments in Rs 2,000 notes as if there's no tomorrow. Will this result in a repetition of the chaos witnessed in November 2016? Only time will unveil the answer. Let us eagerly await and observe this unexpected twist unfold once again. Now, let's move on to the memes.

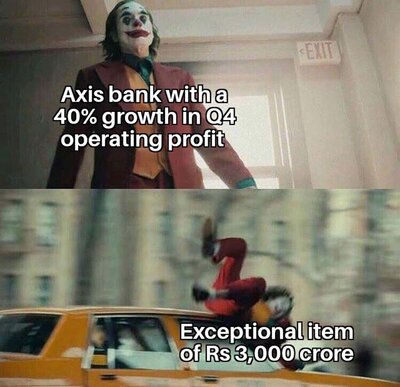

If you are selling your Axis Bank stock because of this, then maybe you should avoid being in the market.

Looking at the crowd in all those fast food chains you might think they are very profitable. That's not the case. That has never been the case actually.

How and why did they make this decision? I really want to know.

The moment reports came in that the probability of recession in India is low, the FIIs rushed here. This is the time where you have to check the change in shareholdings whenever a stock is going up. It could simply be the FIIs buying.

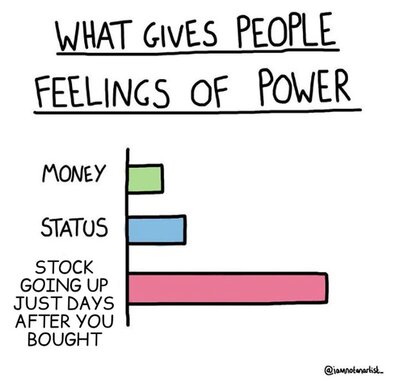

Yes, we ask you to hold forever and all but if the stock goes up immediately, it feels like your thesis is validated immediately too. Wish it never fell after that jump.

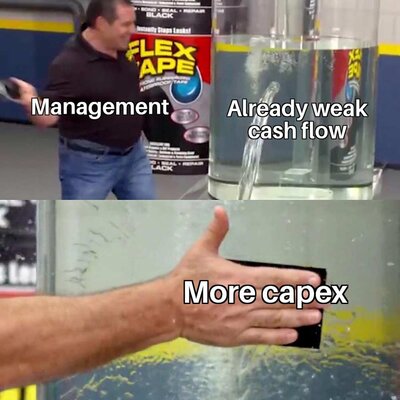

Financials are important, but management? Most important. Their decisions will reflect in ROE and cash flow. If we mess up here then we say bye to returns.

You know what scares Warren Buffett the most? Inflation and taxes. Stock picking is easy for him but the 15 per cent return would be useless if inflation and taxes take away 10 per cent.

Some companies already don't have enough money and are borrowing even for working capital but still continue to spend lavish amounts on capex. Just why? Is the struggle not enough?