In a nutshell

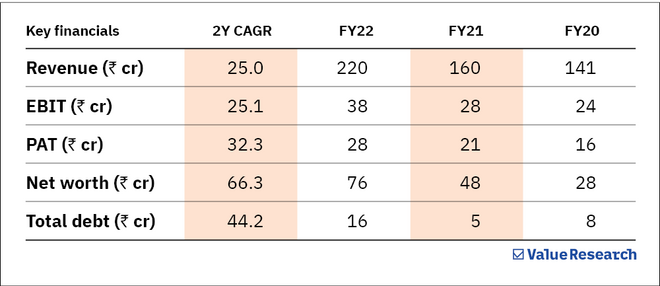

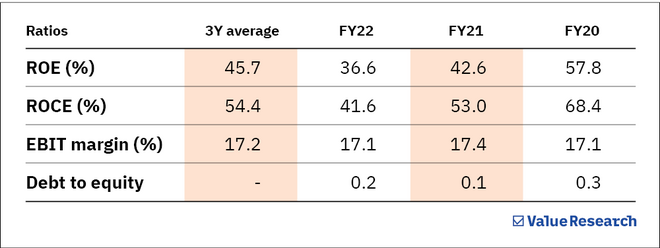

Its topline and profit after tax have grown at 25 and 32 per cent per annum, respectively, over FY20-22. In addition, it has maintained the highest ROE in its segment.

About the company

IKIO Lighting primarily provides LED lighting solutions. It manufactures original designs as well as designs of other OEMs for commercial, industrial and residential applications.

Strengths

: One of the company's promoters (Hardeep Singh) has a 10-year-long relationship with the biggest customer, Signify Innovations (formerly Philips India) has also honoured the promoter with the 'Game Changer' award for LED lighting production.

Weaknesses

: Signify Innovations (formerly Philips India) is IKIO's biggest customer and accounted for over 90 per cent of its revenue in each of the last three fiscal years (FY20-22). However, the same has come down to 70 per cent in the nine months ending December 2022.

Disclaimer: This is not a stock recommendation. Do your due diligence before investing.

Suggested read: Seven questions to ask before you buy a stock