As the markets close on July 12, 2023, HDFC trades for the last time. The next day, it calls itself HDFC Bank.

With the dust settling on the mammoth HDFC merger, let's look at a few interesting facts, including how this coalition will affect mutual funds.

Investment limit for mutual funds

A mutual fund can't invest more than 10 per cent in a single company. Now that HDFC Bank and HDFC have joined forces, 35 equity funds across 20 fund houses will cross the 10 per cent limit. Of the 35, 18 are large-cap funds.

While over a hundred index, sectoral and thematic funds will also breach the 10 per cent limit, we are not considering them because they don't need to observe this rule.

Active funds cry foul

Post-merger, HDFC Bank will have 15 per cent weightage in Nifty 50. Suffice to say that passive funds like index funds and ETFs will have an edge over active funds every time HDFC Bank goes on a run. That's because they don't have to abide by the '10 per cent limit' rule.

Funds to make a fire sale?

Based on portfolio disclosures as of June 30, 2023, mutual funds must dispose of nearly 4,000 crores worth of shares to stay within the 10 per cent Lakshman Rekha. Sounds like a problem? Maybe not.

HDFC and HDFC Bank, combined, have an average daily trading of 2,400 crore shares over the last year (as of June 10, 2023). In fact, it has gone as high as 8,000 crore shares. Therefore, the news of mutual funds having to make a fire sale lacks substance and context.

Busy day for passives

The merger allows LTIMindtree and JSW Steel to enter the Nifty 50 and the Sensex, respectively. This means passive funds will have a busy day because a total of 79 index funds and ETFs hold shares of HDFC.

Darlings of Institutional Investors

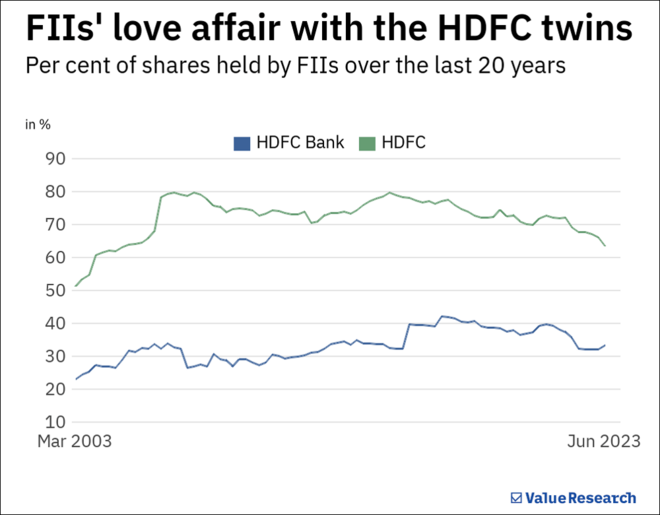

HDFC twins have been the perennial favourites of institutional investors, especially FIIs (foreign investors). There's more scope, too, because HDFC is one of those rare Indian companies that is 100 per cent-owned by the public.

The shareholding pattern over the last two decades illustrates institutional investors' fondness for the company.

Aam aadmi company

The following collection of trivia are for the nerd in you:

- At one point, Citigroup owned more than 12 per cent of HDFC, while JP Morgan owned almost 18 per cent of HDFC Bank. Abrdn Asset Managers, a UK-based investment company, also owned a 13 per cent stake at one point in HDFC.

Interestingly, the Carlyle Group, another investment company, has also held 11 per cent ownership of HDFC. It's interesting because Aditya Puri, the former head of HDFC Bank and the man who propelled them into the big league, joined Carlyle as a senior advisor after stepping down from his bank position.

Closer home, LIC has had 8.5 per cent ownership of the bank. - As mentioned earlier, the heart and soul of HDFC Bank is owned by the public. There are no promoters whatsoever. The only other big Indian companies that make a similar claim are ICICI Bank and L&T.