There's a reason why the popularity of mutual fund investing through the systematic investment plan (SIP) is going through the roof. As per the last count, there were 6.65 crore SIP accounts, up from 3.23 crore just three years back.

And there's a good reason for their meteoric rise. Since SIPs allow your investments to be in auto-mode, it indirectly a) instils a habit to invest, b) compels you to plan your expenses and c) helps you avoid timing the market. Last but not least, it helps you build wealth in a disciplined and systematic way.

The initial hiccup

Given SIP's natural goodness, it's tempting to get started with them immediately.

But before you do, let us inform you of this tiny crack in the mirror: e-Mandate, or one-time mandate (OTM).

This mandate is sent to you by the bank when you plan to start your SIP.

And here lies the catch: some banks charge a one-time fee for setting up an e-mandate, ranging from Rs 50 to Rs 236.

Banks that charge a mandate fee

| Axis Bank | Kotak Mahindra Bank |

| Punjab National Bank | Canara Bank |

Going by the numbers in the table, if you start SIP investments in five mutual funds from your Canara Bank account, you'd needlessly cough out a one-time fee of Rs 885 (Rs 177 x 5 funds). This amount effectively reduces your SIP returns.

That said, a lot of banks don't charge any fees either. Here's a list:

Banks that don't charge a mandate fee

| State Bank of India | ICICI Bank |

| Citi Bank | HDFC Bank |

| IDFC First Bank |

What you should do

If your bank charges a mandate fee, we'd suggest you choose one that doesn't.

If your bank is not mentioned here, visit their official website and check if they charge a one-time mandate. If they do, look for a bank that doesn't.

In other words, this one-time fee can be avoided if you start your SIP from one of these banks.

How to set up a zero-cost mandate

Choose any bank that doesn't charge a mandate fee, say ICICI Bank.

So, if you want the bank to set up a one-time mandate on Coin-Zerodha, these are the following steps:

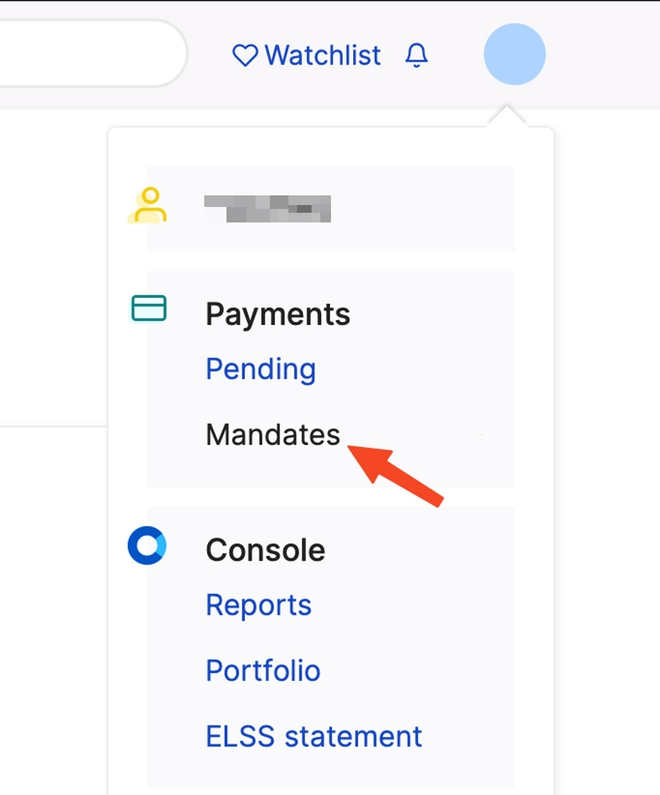

- Click on your profile in the top-right corner and select 'Mandates' under Payments.

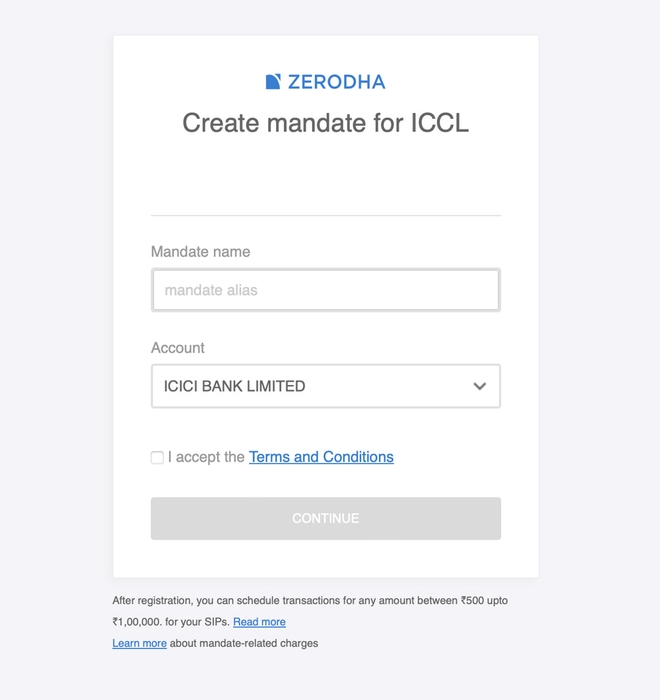

- Then, select the bank account (ICICI in this case) and assign a name to the mandate.

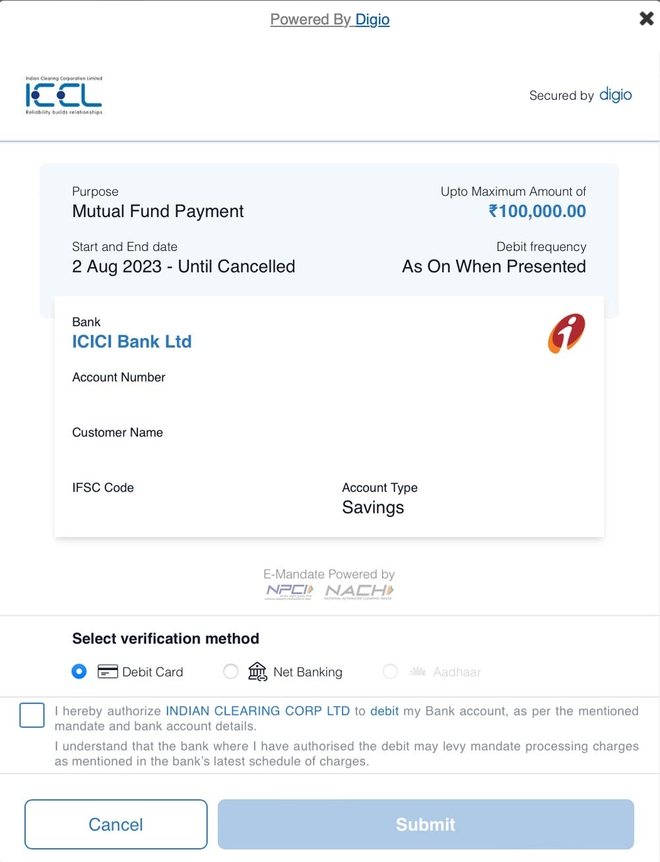

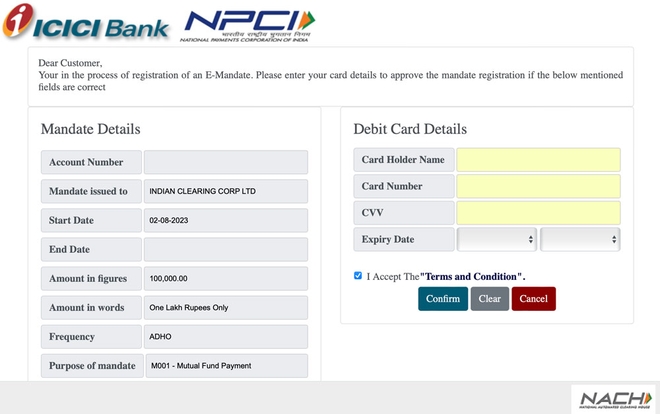

- You now verify it through your debit card or net banking. In this instance, we choose debit card verification.

- You'll get an OTP to verify your details.

The complete process typically takes two to three working days. Once the mandate is created, you can link it with an SIP.

Things to note

- You can link multiple SIPs to a single mandate. But bear in mind that there's a maximum daily limit of Rs 1 lakh for e-mandates. So, carefully plan your SIP dates.

- SIP linked to a mandate can be modified, paused or cancelled, but it must be done two days before the next instalment date.

Suggested read: Want to pause SIPs?: All you need to know