Vaishali, a mother of a two-year-old boy, works with a Pune-based IT firm and earns a lakh monthly. The 35-year-old is putting Rs 5,000 each month in NPS (National Pension Scheme) Tier-1 with the help of her employer for the last five years.

While saving for retirement from a young age is highly commendable, she realises she must also invest for her son's higher education. She was looking at a few mutual funds when one of her colleagues nudged her to explore the NPS Tier-2 route, so she contacted us for help.

What is NPS Tier-2

NPS Tier-2 is an affordable, voluntary investment account. Affordable because the management fees of these funds don't exceed 0.09 per cent. Voluntary because you have the flexibility to invest in equity or debt or both. In addition, going by past data, they have provided double-digit returns. Having said that, do bear in mind that the Tier-2 option is only available to Tier-1 subscribers.

Differences between Tiers 1 and 2

While both fall under NPS, Tier-1 investment is suited for retirement planning and tax-saving purposes. With Tier-1, you can't withdraw your money before 60, barring a few exceptions. And even when you reach that age, you receive only 60 per cent of your total corpus. The rest is moved to annuities.

Tier-2, meanwhile, allows investment withdrawals at your convenience. Just like mutual funds, you can invest through SIP. But unlike actively-managed mutual funds, they charge less management fees. Sure, Tier-2 has additional transaction and withdrawal costs, but the lower management fees can be a significant difference-maker.

NPS Tier-2 vs mutual funds

Performance: Here, we look at the equity component only, because it is the only asset class that can help Vaishali build wealth for her son's higher education in 15-20 years.

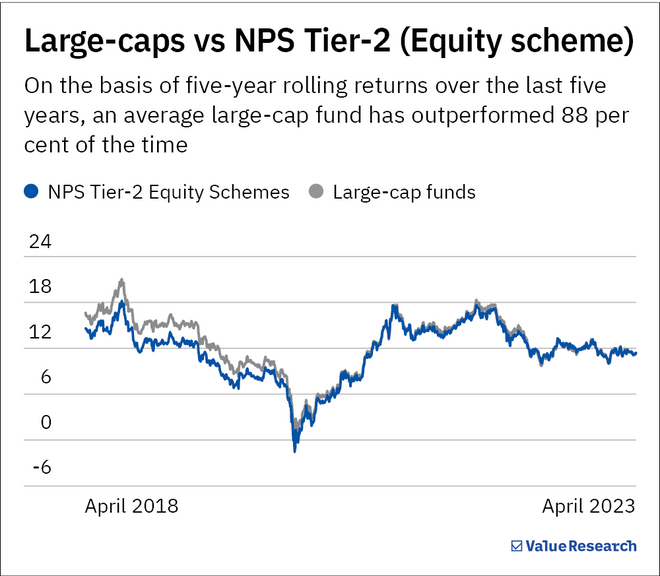

Since Tier-2 equity schemes primarily invest in large-cap companies, we compared them with large-cap mutual funds. Based on five-year rolling returns over the last five years, mutual funds have pipped Tier-2 by just 0.6 per cent after adjusting for management fees. See the graph 'Large caps vs NPS Tier-2 (Equity scheme)'

Mukul Ojha

Mukul Ojha

Tax: Tier-2's hazy taxation policy is a drawback. While tax laws explicitly specify how Tier-1 investments are taxed, it remains silent on Tier-2. As a result, accountants usually treat Tier-2 as debt funds. It means if you hold your investment for over three years, your gains will be taxed at 20 per cent. But since debt funds no longer enjoy indexation benefits, there's even more confusion on how Tier-2 investments will be taxed.

If it's confirmed that Tier-2 investments also won't receive indexation benefits, their long-term tax implications will be significant. You can be taxed up to 30 per cent, depending on your annual income. On the other hand, large-cap mutual fund gains are subject to a 10 per cent tax if you hold the investment for more than 12 months. Hence, mutual funds are more tax-efficient now.

The better option

Since Vaishali has a long-term investment outlook, we'd advise her to look at flexi-cap funds. They outdo large-cap funds (see 'Flexi-caps rule the roost' table above).

Why flexi-caps

Flexi-cap funds will provide Vaishali and other long-term investors with welcome exposure to mid- and small-caps. Why is that good? Because though small- and mid-caps add volatility over short periods of time, they can boost your returns in the long run.

Flexi-cap funds are also more consistent than their largecap peers. Over the last five years (see 'Flexi-cap vs Large-cap funds), flexi-caps have outperformed large-caps more than 90 per cent of the time!

Mukul Ojha

Mukul Ojha

Therefore, Vaishali should put her money in a flexi-cap fund, especially because she has an investment horizon of 15-20 years. If she invests Rs 15,000 monthly in an average flexi-cap fund and increases it by 10 per cent yearly, she can accumulate Rs 1.48 crore in 15 years. We are assuming flexi-cap funds will deliver 13.6 per cent, based on five-year rolling returns over the last five years.

This way, she can give her son the best possible education, possibly send him abroad as well. Let's assume she needs Rs 75 lakh for her son's undergraduate degree, she would still have Rs 73 lakh in her account. If she continues with the same investment plan for another four years, she'd have Rs 1.72 crore - an amount good enough for her son to pursue a prestigious Master's degree!

However, before we conclude, we noticed a small crack in her retirement planning while looking at her financials, which fortunately can be rectified.

The retirement fix

For retirement, Vaishali may maintain a 75:25 allocation in equity and debt; she may earn an average annual return of 11.4 per cent; she may increase the investment amount by 10 per cent each year. Even then, she'd have a retirement corpus of Rs 5.72 crore.

While Rs 5.72 crore may seem like a substantial retirement kitty, Vaishali's current living expenses are Rs 65,000 monthly. Assuming her costs will grow in line with inflation of 6 per cent annually for the next 25 years, she'd need a retirement corpus of Rs 7.49 crore (Rs 1.77 crore more), so she can comfortably sustain her lifestyle for the next 25 years. Fortunately, this deficit can be bridged by flexi-cap funds, too, if she invests Rs 3,500 each month and increases it by 10 per cent each year.

Don't forget

- Maintain a contingency fund equivalent to at least six months of expenses, including EMIs.

- Have an adequate life cover.

- Get health cover for all family members.