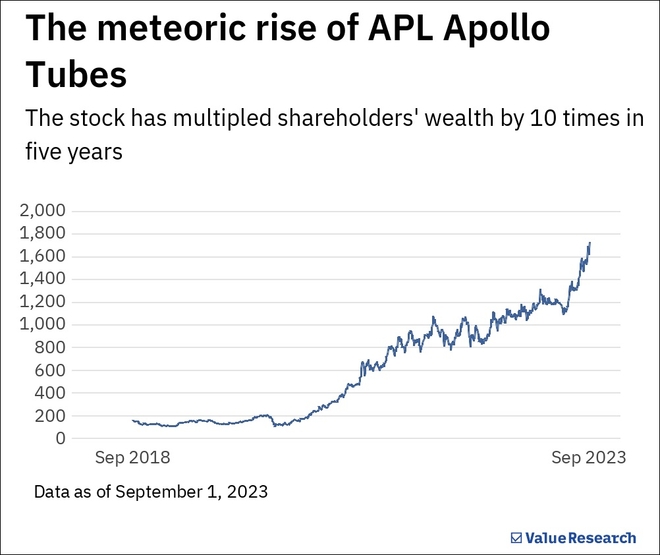

APL Apollo Tubes , a structural steel pipe (used as construction material) manufacturer, has been on a dream run. The stock has multiplied more than ten times in the last five years.

This rally is no happenstance. The company's financial performance has been in line with its rising share price. In the last five years, it has grown its sales and net profit annually by 24.8 and 32.3 per cent, respectively. Its capital efficiency has also remained impressive, with a five-year median ROE of 23.5 per cent.

Revenue and profit have scaled remarkably

A significant bump can be seen in FY22

| Year | Revenue (Rs cr) | PAT (Rs cr) | ROE (%) |

|---|---|---|---|

| FY18 | 5335 | 158 | 20.7 |

| FY19 | 7152 | 148 | 16.6 |

| FY20 | 7723 | 238 | 22.2 |

| FY21 | 8500 | 360 | 26.8 |

| FY22 | 13063 | 619 | 29.9 |

| FY23 | 16166 | 642 | 23.5 |

| 5Y growth (%) | 24.8 | 32.3 | |

|

PAT is profit after tax ROE is return on equity |

|||

Here are the prime reasons behind this steel manufacturer's meteoric rise.

Growing acceptance of steel tubes in construction

Historically, steel tubes were primarily used for the transportation of fuel and gas in India. Unlike the Western nations, Indians have mostly favoured concrete over structural steel for infrastructure. This was partly due to cultural preference and the relatively higher skilled labour required for constructing steel structures compared to concrete structures.

However, rising urbanisation and population density have increased the demand for vertical structures, i.e., highrise skyscrapers, primarily made using structural steel. APL Apollo, one of the largest producers of structural steel tubes, has benefitted immensely from this rising demand, reflected in its rising sales over the years.

The cost advantage

APL Apollo accounts for nearly 2 per cent of Indian steel consumption. This gives it an edge over its peers as it procures raw materials at considerably higher volumes than most of its peers and, thereby, at lower rates. In addition, the company has been a frontrunner in adopting new technologies to improve operating efficiency. For example, it was the first in the industry to adopt Direct Forming Technology, which significantly accelerates the manufacturing process. This has enabled it to cater to high-margin smaller orders and has improved overall cost efficiency.

In addition, its pan-India presence, with plants situated in North, West, South and Central India, provides it with an additional cost advantage of lower freight costs.

A word of caution

Note that this is not a stock recommendation. We have always iterated that you should never invest based purely on past performance. Valuation, future growth prospects, etc., should also be considered. For example, the stock presently trades at a P/E of 65 times, significantly higher than its five-year median P/E of 35 times.

Furthermore, as a capital-intensive industry, there's a constant risk of accumulating substantial debt. Although the company's financials are relatively robust compared to others in the sector, the inherent nature of the business could potentially lead to unmanageable debt levels down the road. Additionally, the volatility in steel prices remains a persistent threat.

In short, always do the due diligence before you invest.