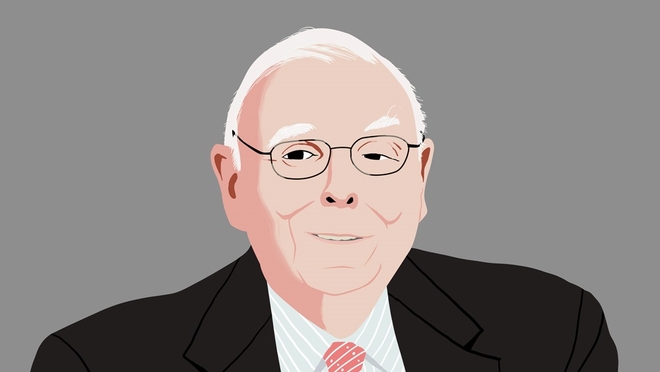

Charlie Munger needs no introduction. The Vice Chairman of Berkshire Hathaway has inspired a generation of investors. However, his remarkable market insights and uncanny ability to identify wealth-building opportunities aren't the only qualities that set him apart. Munger's sharp wit is equally renowned in investing circles.

Here are five witty quotes from Charlie Munger that can help you become a better investor:

Beware of bull***t

In the world of finance, be vigilant about "bull***t." Consider this: If you operate a grocery store and pay Rs 10,000 in monthly rent while earning Rs 8,000 on average, would you call it a profitable business?

Well, if you knew about adjusted EBITDA, you can. Just say you "adjusted" the rent. That is how absurd adjusted EBITDA is.

Munger once quipped, "Every time you saw that word (adjusted EBITDA), you just substituted the phrase with 'bullshit earnings".

Adjusted EBITDA is just one of the many accounting gimmicks managements use. As an investor, you should always scrutinise the management and beware of their, as Munger says, "bull***t".

Pay no heed to the noise

In the market, there's a surplus of hype and doomsday predictions. When the economy is thriving and the market is scaling new highs, punters hype up investments that would make any sensible investor cringe. Conversely, when the economy is in the doldrums, the sirens will be rung, and many will claim that this is the end of the global financial system as we know it.

The truth is long-term wealth creation lies in paying no heed to the market noise and identifying long-term wealth creators that can ride out both moods of the market.

Munger aptly summarised this when he said, "if people weren't so often wrong, we wouldn't be so rich".

Embrace new information

Admitting mistakes, especially those that cost you money, can be challenging. Investors often ignore glaring information and cling to duds. While holding investments for the long term is essential, it's equally crucial to be receptive to acknowledging a poor decision.

Munger pointed out this common investing pitfall when he said, "It's extraordinary how resistant some people are at learning anything."

There's no alternative to profits

Profits are the lifeline of a business. Sounds obvious. However, in the era of growth at all costs, it is important to remind ourselves that, in the long run, a business cannot survive without profits. Regardless of what the majority is saying, if a company has been guilty of the loss-making sin far too often, stray away.

Munger, too, has always kept loss-makers at bay. He says, "Well, there are a lot of things that I don't think about. And of them is companies that are losing two or three billion dollars per year and going public".

Find your own mojo

What worked for your friend might not work for you. Your investment philosophy should always account for your investment goals and risk appetite. There's no one-size-fits-all investment philosophy.

Even Munger agrees there's no universal formula that is applicable to all investors. He says, "I can't give you a formulaic approach, because I don't use one. If you want a formula, you should go back to graduate school. They'll give you lots of formulas that won't work."

Also read: Howard Marks' art of risk management