Index funds have gained massive popularity in recent years. Although mutual funds track various indices, the ones following the Sensex and Nifty are the most popular due to the following reasons:

- Both these indices are home to some of the largest companies in India.

- Since they are a benchmark for the Indian market, the media - both domestic and international - provide regular updates, making them accessible and popular among investors.

- The companies in these indices are widely traded, making them highly liquid.

- Both indices include stocks from various sectors, providing a level of diversification.

Given their wide mass appeal, it's unsurprising that of the Rs 5.29 lakh crore of investor's money in equity-based index funds and ETFs, an overwhelming 79 per cent of the money is with funds tracking the Nifty and the Sensex.

Same difference (almost)

Now that we have established the popularity of Nifty and Sensex index funds, let us understand the broad differences between the two.

For starters, the Sensex tracks the performance of the 30 most actively traded stocks on the Bombay Stock Exchange (BSE). In contrast, the Nifty tracks the performance of the 50 most actively traded stocks on the National Stock Exchange (NSE).

That said, there is a substantial overlap between the two indices. In fact, the Nifty is home to all the 30 Sensex companies as well, based on the portfolio of two index funds as of September 30, 2023. Simply put, the Nifty and Sensex are 86.67 per cent identical.

In short, there is little difference between the two from a portfolio perspective.

Little to no difference

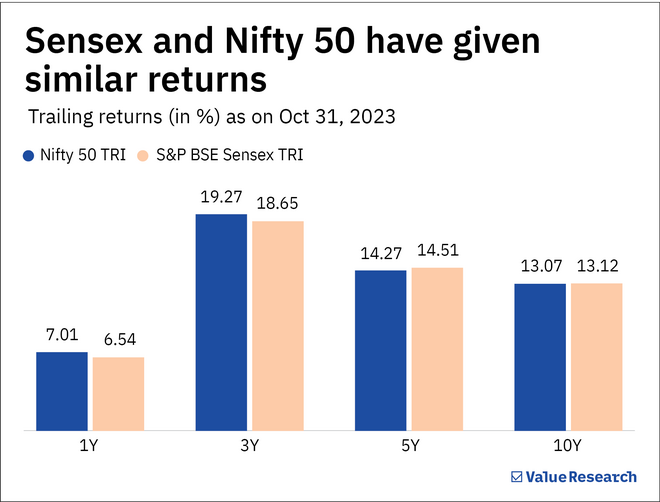

From a performance perspective, too, there is little difference.

The trailing returns - from one specific date to another - are neck and neck.

The five-year rolling returns chart, meanwhile, shows the Sensex to be marginally ahead. (Rolling returns are a series of trailing returns. It is a better indicator of an investment's consistency.)

What you should do

There isn't any meaningful difference between the two. So, regardless of which passively-managed index fund you choose, we suggest you start now. Both can help you build wealth in the long run.

Also read: The time to start is now