Mutual fund taxation underwent a significant shift since April 1, 2023. Originally, funds were categorised as equity funds or non-equity funds, with equity funds requiring a minimum 65 per cent allocation in equities. The new system further breaks down the non-equity category based on equity exposure into two subgroups: up to 35 per cent in equities and between 35 per cent and 65 per cent in equities.

With that context in mind, let's first learn what multi-asset funds are before understanding their taxation.

What are multi-asset funds?

Multi-asset allocation funds are a mutual fund category that invests at least 10 per cent each in equities, debt, and a third asset class, such as gold or real estate. Beyond the minimum 10 per cent, fund managers can adjust allocations in any proportion, which gives these funds their distinct nature.

Taxation of multi-asset funds

In order to find out how mutual funds are taxed, we have to look at their average equity allocation over the past 12 months, and not simply as of today. This becomes interesting, particularly in the case of multi-asset allocation funds where the equity allocation is dynamic and the fund manager is free to change it any moment as per their strategy.

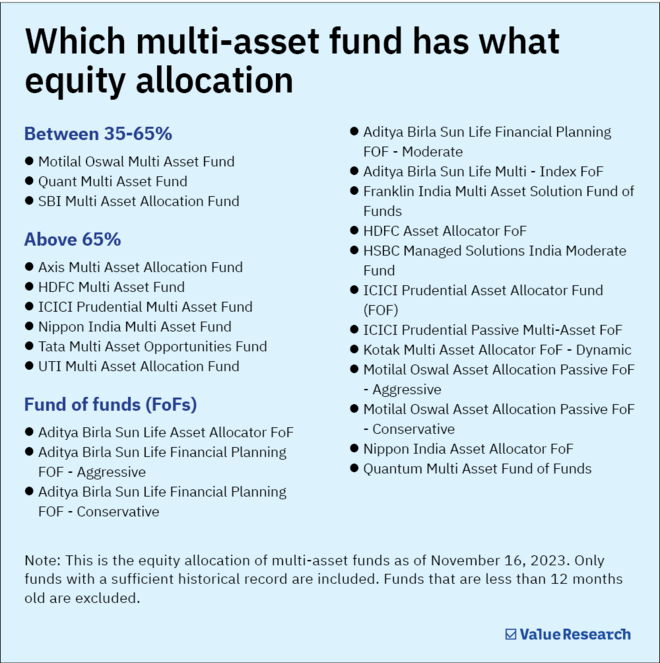

Upon analysis, here's what we found:

- Three multi-asset funds have an equity allocation between 35-65 per cent

- Six have an equity allocation over 65 per cent, and

- Fifteen were fund of funds (FoFs)

Here's how they will be taxed

| Domestic equity exposure | Short-term capital gains | Long-term capital gains |

|---|---|---|

| Up to 35 per cent | As per tax slab | As per tax slab |

| Between 35-65 per cent | As per tax slab | For a holding period of more than three years, taxed at 20 per cent with benefit of indexation |

| Above 65 per cent | Taxed at 15 per cent | For a holding period of more than one year, taxed at 10 per cent (on gains above Rs 1 lakh) |

Taxation of FoFs

If the investment in FoF is made on or after April 1, 2023, gains are added to the income and taxed as per the applicable slab. If it is done before April 1, 2023, gains are taxed at 20 per cent after providing the benefit of indexation if held for more than three years, otherwise they are added to the income and taxed as per the applicable slab.

Value Research Online at your service

Given the dynamic nature of multi-asset allocation funds, staying informed about strategic shifts and the resulting tax implications is crucial.

Though this is the tax status of multi-asset funds as of today, as explained above, it can change depending on their equity allocation. That is where our website, Value Research Online, can aid you. We update the taxation of these funds on a real-time basis after calculating their average equity allocation.

Simply search for your multi-asset fund on our website and scroll down to the 'Taxation' section of the fund page for the latest tax information.

Also read: Indexation benefit is gone, debt funds lose tax advantage