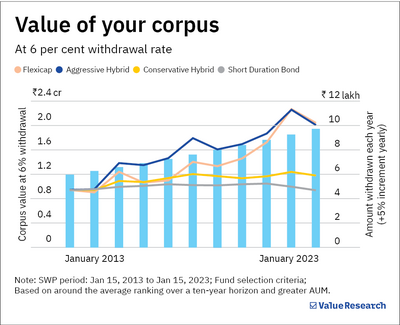

Building a sizable corpus is a battle half won; the other half is preserving it. This is why you must formulate a strategy to ensure your story doesn't become part of the riches-to-rags list. To avoid the descent from affluence to financial stress, you need to know two crucial elements: where to stash your money and how much you can annually withdraw to finance your daily life.

So, without further ado, let's look at the different funds you can invest and establish an annual withdrawal rate to ring-fence your hard-earned wealth. Do note that this analysis is based on historical data to help you take cues and form expectations only.

Option 1: Flexi-cap funds

Where they invest

100 per cent money in equity

Assuming you put Rs 1 crore corpus here 10 years back...

- And withdrew 4 per cent, you'd now have Rs 2.62 crore

- And withdrew 5 per cent, you'd now have Rs 2.34 crore

- And withdrew 6 per cent, you'd now have with Rs 2.05 crore

Pros

Given the growth potential of equity, you can end up having an even larger corpus than you originally invested.

Cons

Putting all your money in an equity fund can be a rollercoaster ride. For example, during these ten years, your corpus would have swung between Rs 90.93 lakh and Rs 2.28 crore if your annual withdrawal rate was 6 per cent.

Corpus in danger?

Three. The number of times the value of your corpus would have come close to the starting principal amount (of Rs 1 crore) in the last ten years if your annual withdrawal was 6 per cent.

Even though this option can accelerate your investment, there is a risk of a diminished corpus because equity can have massive fluctuations over short periods of time.

Our take

Putting sizable money in an equity fund can be tricky, given the volatility. So, consider investing in a flexi-cap fund only if you don't depend on it for regular income and have another income source.

Option 2: Aggressive hybrid fund

Where they invest

Equity: 65-80 per cent | Debt: 20-35 per cent

Assuming you put Rs 1 crore corpus here 10 years back...

- And withdrew 4 per cent, you'd now have Rs 2.5 crore

- And withdrew 5 per cent, you'd now have Rs 2.26 crore

- And withdrew 6 per cent, you'd now have Rs 2.01 crore

Pros

Its performance is similar to an equity fund and provides growth potential.

Cons

Considering the volatility of equity as an asset class, the corpus would have dipped to Rs 95.16 lakh at some point in the last ten years.

Corpus in danger?

One. The number of times the value of your corpus would have come close to the starting principal amount (of Rs 1 crore) in the last ten years if your annual withdrawal was 6 per cent.

Our take

Although it can be volatile, it is relatively more stable than a 100 per cent equity fund (like a flexi-cap fund).

This option suits investors with low dependency on the corpus for regular income.

Option 3: Conservative hybrid fund

Where they invest

Equity: 10-25 per cent | Debt: 75-90 per cent

Assuming you put Rs 1 crore corpus here 10 years back...

- And withdrew 4 per cent, you'd now have Rs 1.61 crore

- And withdrew 5 per cent, you'd now have Rs 1.4 crore

- And withdrew 6 per cent, you'd now have Rs 1.19 crore

Pros

Safer and less risky compared to the previous two options.

Cons

You run the risk of ending up with a lower corpus compared to the two options mentioned above.

Corpus in danger?

Seven. The number of times your corpus value would have eroded in the last ten years if your annual withdrawal was 6 per cent. That's mainly because this fund category is mainly invested in debt and, as a result, grows your corpus at a slower pace.

Our take

Ideal for risk-averse investors relying on the corpus for regular income.

Option 4: Short-duration debt fund

Where they invest

100 per cent money in debt

Assuming you put Rs 1 crore corpus here 10 years back...

- And withdrew 4 per cent, you'd now have Rs 1.34 crore

- And withdrew 5 per cent, you'd now have Rs 1.14 crore

- And withdrew 6 per cent, you'd now be left with just Rs 94.2 lakh

Pros

Least risky and volatile.

Cons

This is a low-risk, low-reward option, so your corpus will grow slowly. If you withdraw slightly higher amounts (check the 6 per cent withdrawal number), you can eat into your Rs 1 crore corpus.

Corpus in danger?

10. The number of times the value of your corpus would have come close to the starting principal amount (of Rs 1 crore) in the last ten years if your annual withdrawal was 6 per cent.

Our take

Although safe, there are better choices than putting all your money in debt, as it can lead to capital erosion in the long run.

Your takeaway

- Annual 6 per cent withdrawal could have led to diminished corpus at various times in the last 10 years. So, it's best to look at lower withdrawal rates.

- The 6 per cent withdrawal rate can be harsh particularly for those with Rs 1 crore corpus in a short-duration debt fund. Even conservative hybrids come too close to shaving off your corpus in 10 years.

- Pure equity funds - like flexi-cap funds - can enlarge your corpus significantly but at a relatively higher risk. The 100 per cent equity option can be precarious for retirees.

- Aggressive hybrid funds appear to be the best fit. They can grow your corpus and protect your original investment more often than not.

Finally, for those who are interested in our methodology, here is how we assessed the four types of funds to answer your questions:

- The Rs 1 crore corpus was put in direct plans of these funds in January 2013.

- The annual 4, 5 and 6 per cent withdrawals were done on January 15 of each year.

- We calculated the pre-tax corpus and assumed a 5 per cent incremental withdrawal each year to cope with inflation.

- We selected the funds based on around the average ranking in the last 10 years.

- Equity savings funds were excluded as they had only one fund in the 10-year ranking.

Also read: SWP - Finding the ideal equity allocation